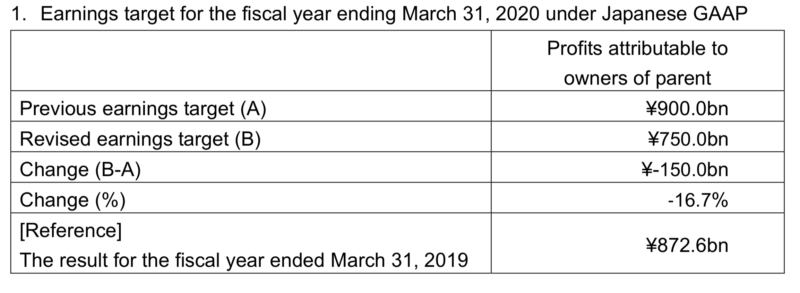

Mitsubishi UFJ Financial Group cuts FY2020 profit forecast by ¥150bn

The downward revision represents a 16.7% cut from the previous earnings forecast.

Mitsubishi UFJ Financial Group Inc (TYO:8306), also known as MUFG, has earlier today released a notice regarding its earnings outlook for the fiscal year to end-March 2020.

MUFG revised its earnings target for profits attributable to owners of parent for the fiscal year ending March 31, 2020, originally announced on May 15, 2019. The previous forecast was for annual earnings of ¥900 billion, whereas the revised estimates point to a target of ¥750 billion. The cut is 16.7%, or ¥150 billion.

Dividend forecasts are unchanged.

In the consolidated financial statements for the third quarter of the fiscal year ending March 31, 2020 under Japanese GAAP, an extraordinary loss of ¥207.4 billion was recorded due to the one-time amortization of goodwill associated with an impairment of PT Bank Danamon Indonesia, Tbk. stock. In accordance with this loss, MUFG has revised its earnings target downward based on the share price as of December 31, 2019.

If Bank Danamon’s share price recovers at the end of the fiscal year, the amortization will be reversed for the full fiscal year ending March 31, 2020. Accordingly, actual results may change significantly depending on Bank Danamon’s share price at the end of the fiscal year, MUFG notes.

In May 2019, MUFG’s core banking subsidiary MUFG Bank announced that its consolidated subsidiaries, PT Bank Danamon Indonesia, Tbk, and PT Bank Nusantara Parahyangan Tbk. completed their merger. As a result of the deal, MUFG Bank holds a 94.1% stake in Bank Danamon.