Monex Group’s refocus on domestic Japanese FX market: February volumes highest for a year

As controversial as it may appear to assume any connection between the massive increase in volumes experienced by Japanese electronic trading giant Monex Group, Inc. (TYO:8698) during February and its congruent exit from the US market by selling the client base of its US subsidiary IBFX to OANDA Corporation, it is certainly worthy of consideration that the […]

As controversial as it may appear to assume any connection between the massive increase in volumes experienced by Japanese electronic trading giant Monex Group, Inc. (TYO:8698) during February and its congruent exit from the US market by selling the client base of its US subsidiary IBFX to OANDA Corporation, it is certainly worthy of consideration that the concentration on the domestic market by Monex Group has been long considered.

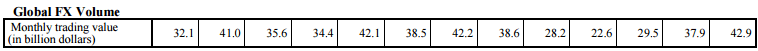

Today, the company announced its monthly volume figures for February 2016, which amounted to $42.9 billion, which is higher than any month during the entirety of 2015, and with the exception of the four month high between September and December 2014, higher than the volumes achieved in the second and third quarter of that year also.

![]()

Japan’s retail FX industry represents approximately 35% of the world’s retail order flow, however the interesting aspect with regard to such a vast market is that it is almost entirely domestic. Japanese clients are very loyal to Japanese FX companies, the three dominant firms DMM Securities, GMO Click and Monex Group having a majority Japanese client base.

A very interesting observation is that Monex Group’s divestment from non-Japanese markets has been conducted in two stages, the first being the sale of the IBFX MetaTrader 4 client bases in Australia and the US in September 2014, leaving the remaining IBFX customers in the US with the proprietary Tradestation platform, before selling that client base to OANDA last week, representing an exit from the US altogether by Monex Group.

The two periods during which Monex Group executed these transactions were periods of high global FX trading volumes, as September 2014, the month during which Monex offloaded its IBFX MetaTrader 4 client base, was a month in which $43.5 billion was traded, the highest since March that year, and substantially higher than in August 2014, during which only $29.3 billion in volume was achieved.

Subsequent to the sale of the MetaTrader 4 clients in the US and Australia, Monex Group’s global FX volumes soared to levels that were higher than any period in 2014 and that have not been repeated since. In October 2014, the company recorded $52.4 billion, followed by $55.4 billion in November and $53.9 billion in December.

By selling the remaining IBFX client base which uses the Tradestation platform after a month of higher volumes than all year, Monex Group’s corporate strategy can be considered to be one which looks toward the land of the rising sun.

Indeed, Tradestation’s number of active accounts increased from 68,419 in January this year to 68,796 in February, demonstrating a very sustainable business and a shrewd purchase by OANDA Corporation, however when considering that Tradestation and IBFX are regarded as prominent firms in the US, an Monex Group’s exit strategy during times of high revenues, it is clear that a focus on the Japanese market, in congruence with its competitors GMO Click and DMM Securities remains a priority for Monex Group.