Monex to offer special AI-based market report

Monex has partnered with Good Moneyger to provide an AI-based report on market opportunities.

Japanese online trading company Monex Inc, a subsidiary of Monex Group, Inc. (TYO:8698), has announced the start of delivery of a new market analysis report. The interesting part about this service is that it is based on the work of an Artificial Intelligence (AI) program.

To deliver the “Monex AI Report”, the broker has teamed up with fintech company Good Moneyger, whose AI solution – VESTA, seeks to reduce chances of investment loss by examining market data and cycles and estimating chances of market crashes.

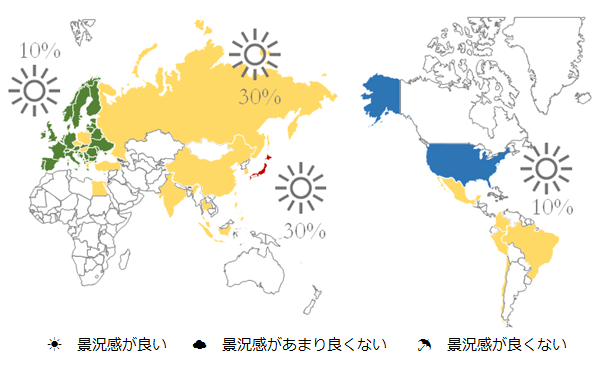

The report itself is intended to be simple and understandable – it rates the investment score of various asset classes based on a three-stages scale. There is also a “weather forecast” for the global market, with a map reflecting the business confidence in various regions (see below).

The report will be delivered via email, via Monex’s social media channels and via Monex’s website.

Monex is not the first Japanese Forex broker to adopt AI solutions. Recently, Kabu.com Securities, a subsidiary of Mitsubishi UFJ Financial Group Inc (TYO:8306), has unveiled its plans to launch a special AI-powered solution for its clients. The tool, named “AlpacaSearch for kabu.com” is developed in co-operation with AI startup AlpacaDB Inc, and is set to go live on May 11, 2017. The solution will be available to stock traders using Kabu Station Premium.

Japan’s financial services sector has embraced new technologies and AI, in particular. A widely known example has been provided by Japan’s Fukoku Mutual Life Insurance, which, in early 2017, announced plans to implement IBM’s Watson Explorer Artificial Intelligence system in a change resulting in the lay-offs of 34 of its employees. In February this year, Japan Exchange Regulation (JPX-R) and Tokyo Stock Exchange, Inc. (TSE) announced they were working on using AI for market surveillance operations with the help of technologies developed by NEC Corp (TYO:6701) and Hitachi, Ltd. (TYO:6501). Tests showed that AI solutions were highly precise in identifying the possibility of unfair trading and enabling prevention of such abusive practices.