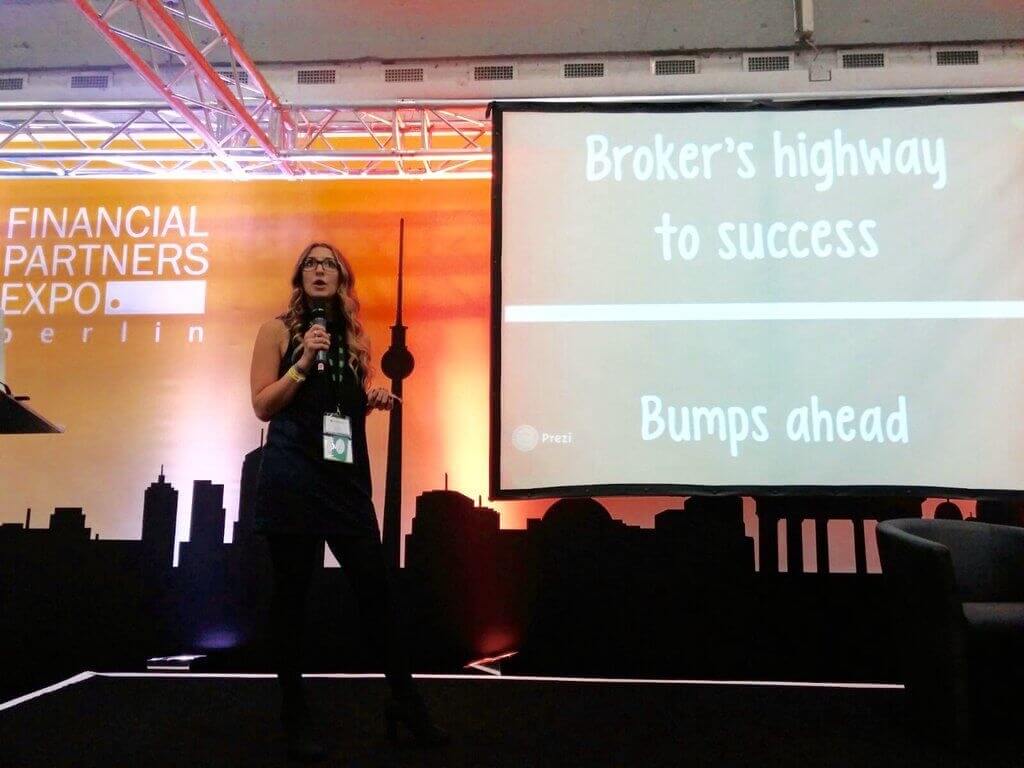

Movers & Shakers! Rachel Sartini to help you launch one of the most unique brokers to hit the market?

A new year, a new era of innovation, and in the fast-moving FX industry, those at the cutting edge who are not content with simply going through the motions and emulating their peers before heading home at the end of the working day will likely reveal yet more industry-changing developments. To give an insight […]

A new year, a new era of innovation, and in the fast-moving FX industry, those at the cutting edge who are not content with simply going through the motions and emulating their peers before heading home at the end of the working day will likely reveal yet more industry-changing developments.

To give an insight into the personality, charisma and just what makes such things happen, FinanceFeeds met with some of the movers and shakers of the industry for an open and casual discussion on what the industry is likely to look like, with a splash of comedy for those who appreciate.

What’s new?

Wow, I wouldn’t even know where to start. The past year was filled with so much new for the binary industry as a whole, and especially for B2Binary and myself personally. I am still feeling the excitement from 2015. But it’s a new year and we are ambitious and ready for 2016.

We feel service and technology providers have really started to collaborate more, going deeper with integrations, to offer even more possibilities to brokers than last year. The innovation in our industry is becoming more creative and out-of-the-box than before, and this is a great opportunity for B2Binary and our clients.

There are many new changes in the industry and upcoming brokerages launching. Many major names in the industry have left leading roles in mainstream companies to branch out and open their own boutique niche brands. We have been working with a few major projects recently that are showing huge potential for 2016, so we expect it to be a big year.

Ok, so nobody is perfect. What is the biggest thing you can improve on from last year?

Well the first improvement will be to expand B2binary’s team this year. We have great relationships with our partners, and I want to work on strengthening these connections even more. Of course a bigger team also means more opportunity, which I am happy to welcome. This year will be a big step forward for B2Binary, we will definitely have more presence than we did in 2015. Let’s just say it will be hard to miss us.

Funniest thing/ incident that happened in the office last year? Any cringe / epic fail moments?

Ha, well I guess I probably had a few of those.

If we are sitting here in one year from now discussing what you as a company have achieved in 2016, what do you hope to be the big achievements?

Maybe to help successfully launch one of the most unique brokers to hit the market? I am confident to say that if we do have that discussion in one year from now, there will be quite a few mentionable achievements. We have big plans for 2016. Life is short, let’s dream big.

If your company morphed into a super-hero or animal in 2016; what would it be?

Hmmm…I love animals, that’s a tough one. I guess Cat Woman is the best combination of both super hero and animal. She’s bulletproof with a feline empathy and speed, plus she can cling to walls.

See more Movers & Shakers