Mr Dror Niv – Status Inactive, UK Financial Services Register shows

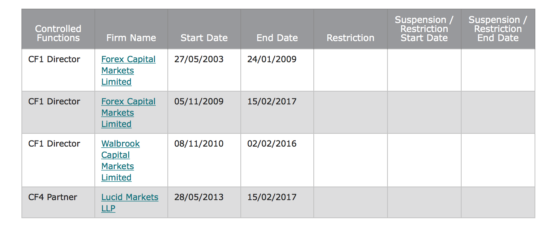

Updated Register shows Drew Niv ceased being a partner at Lucid and a director at FXCM UK on February 15, 2017.

While the situation for former US retail FX clients of FXCM Inc (NASDAQ:FXCM) is now clearer thanks to information provided about their transfer to Forex.com, the retail FX subsidiary of Gain Capital Holdings Inc (NYSE:GCAP), too many questions remain pending as to the future of non-US businesses operating under the FXCM brand. This is in the face of statements by FXCM Inc that the overseas businesses will not be affected by the regulatory actions against its US operations and principals.

There has been an update to the UK Financial Services Register (maintained by the Financial Conduct Authority and the Prudential Regulation Authority) with regards to Dror Niv (Drew Niv), who was banned from US National Futures Association membership and from acting as a principal of an NFA Member on February 6, 2017. The NFA Decision has yet to come into force – it will become effective on February 21, 2017.

Meanwhile, as per the latest FCA Register update, Mr Niv has a status “Inactive” assigned to his name.

According to the regulator, there are two possible reasons an individual may be shown as ‘inactive’. Either they are no longer approved by the FCA, or they may work for a firm subject to the new Senior Managers and Certification Regime, which came into effect in March 2016 and covers banks, building societies, credit unions and PRA designated investment firms.

A more detailed check shows that Mr Niv ceased to be a director of Forex Capital Markets Limited (FXCM UK) on February 15, 2017. FinanceFeeds has already informed you of this move, which was reported to the UK Companies House service a couple of days earlier.

In addition, the FCA register shows that Mr Niv abandoned his functions as a partner in Lucid Markets LLP, a non-bank electronic market making and trading firm in the institutional foreign exchange market, on February 15, 2017. This is barely surprising, given that FXCM has voiced its intentions to dispose of Lucid, as it sought to repay its loan to Leucadia.

The UK Companies House service shows Lucid Markets LLP has 14 current officers. The company remains authorized in the UK, according to the FCA Register. FXCM UK is also active and authorized, as per the FCA Register.

Another company that saw board changes as a result of revelations concerning FXCM US is FastMatch, which has replaced former directors Drew Niv and William Ahdout with Brian Friedman, President, and Jimmy Hallac, Managing Director, of Leucadia National Corp. (NYSE:LUK).