Nasdaq reports net income of $150m in Q3 2019, down from $163m a year earlier

On a GAAP basis, net income in the third quarter of 2019 was $150 million, compared to net income of $163 million in the year-ago quarter.

Nasdaq Inc (NASDAQ:NDAQ) has earlier today reported its financial results for the third quarter of 2019, with the data pointing to a rise in revenues, although net income was lower than a year earlier.

The company reported third quarter 2019 net revenues of $632 million, up $32 million from $600 million in the prior year period.

The rise is manifested across all segments. Thus, the Market Services segment, which generates 36% of total net revenues, saw net revenues of $226 million in the third quarter of 2019, up $4 million, or 2%, when compared to the equivalent period a year earlier. Information Services, which account for 31% of total net revenues, marked revenues of $198 million in the third quarter of 2019, up $19 million, or 11%, from the third quarter of 2018. Market data revenues were $102 million in the third quarter of 2019, up $7 million from the third quarter of 2018, primarily due to new proprietary data sales as well as higher U.S. tape revenues related to collections from unreported usage.

Investment data & analytics revenues were $40 million in the third quarter of 2019, up $8 million from the third quarter of 2018. This was primarily due to an increase in eVestment revenues resulting from a $4 million purchase price adjustment on deferred revenue in the third quarter of 2018 and organic growth in eVestment, as well as a $1 million impact from the acquisition of Quandl.

Market Technology revenues were $84 million in the third quarter of 2019, up $16 million, or 24%, from the third quarter of 2018. The increase is primarily due to the impact of the acquisition of Cinnober, which added $11 million in revenues, or 16%, and organic growth of $6 million, or 9%. The organic growth was primarily driven by an increase in software as a service (SaaS) surveillance revenues and an increase in the size and number of software delivery projects.

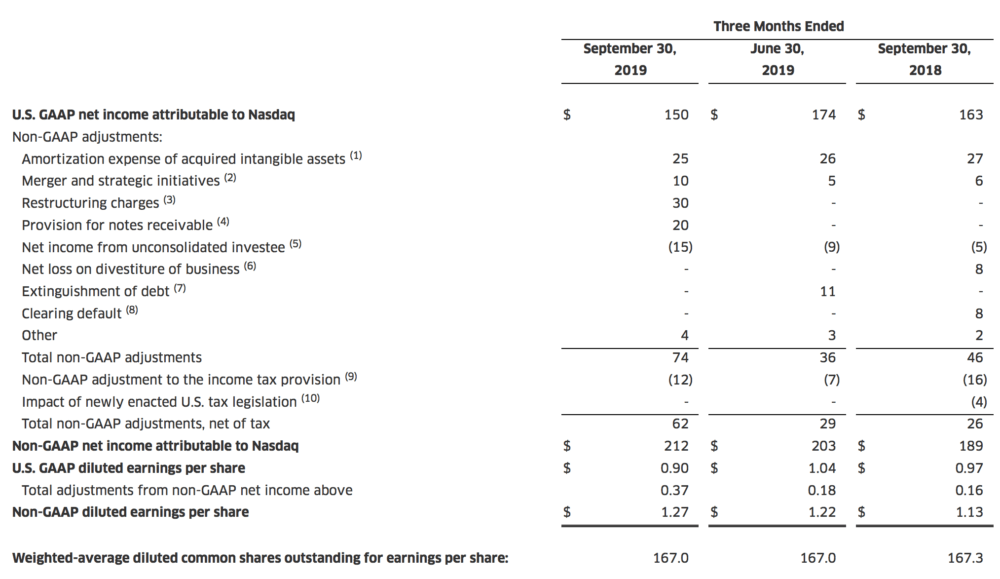

On a GAAP basis, net income in the third quarter of 2019 was $150 million, or diluted earnings per share of $0.90, compared to net income of $163 million, or $0.97 per diluted share, in the third quarter of 2018.

On a non-GAAP basis, net income in the third quarter of 2019 was $212 million, or $1.27 per diluted share, compared to $189 million, or $1.13 per diluted share, in the third quarter of 2018.

In September 2019, Nasdaq commenced the transition of certain technology platforms to advance the company’s strategic opportunities as a technology and analytics provider and continue the re-alignment of certain business areas. Due to these restructuring efforts, Nasdaq is retiring certain elements of its marketplace infrastructure and technology product offerings as it implements the Nasdaq Financial Framework internally and externally.

As a result of these actions, Nasdaq expects to incur $65 million to $75 million in pre-tax charges over a two year period (including $30 million in the third quarter of 2019) related primarily to non-cash items such as asset write-downs, accelerated depreciation as well as third-party consulting costs.