“Never admit to clients that we have ever flown rates”, TFS-ICAP’S Woolfenden tells NY broker

“Appreciate if you could keep this quiet”, Woolfenden instructed David Walter, a TFS-ICAP options broker based in New York.

The United States Commodity Futures Trading Commission (CFTC) has earlier today filed with the New York Southern District Court a set of documents that serve as evidence in its action against interdealer broker TFS-ICAP, Chief Executive Officer, Ian Dibb, and the Head of Emerging Markets broking, Jeremy Woolfenden. The documents, seen by FinanceFeeds, include excerpts from emails, chats and phone correspondence.

Let’s recall that, according to the CFTC Complaint, from approximately 2008 through 2015, brokers at TFS-ICAP offices in the United States and the United Kingdom attempted to deceive and deceived their clients by engaging in the practices of communicating to them fake bids and offers and fake trades in the foreign exchange options market. The CFTC Complaint alleges that the practices, known as “flying prices” and “printing trades”, were a core part of TFS-ICAP’s broking business.

According to the CFTC, the New York Southern District Court has personal jurisdiction over Mr Woolfenden because his actions caused the underlying misconduct at issue in this case – flying & printing trades. TFS-ICAP brokers made misrepresentations to US-based clients because they had been trained and encouraged to do so by Mr Woolfenden. Though Mr. Woolfenden lived in London, as the Global Head of Emerging Markets FX Options he directly supervised and managed these US- and London-based brokers through at least mid-August 2015. Moreover, he registered with the CFTC in the United State as an associated person of two CFTC-registered entities.

As FinanceFeeds reported in May this year, the counsel for Mr Woolfenden argued that the CFTC was not able to muster allegations that establish the New York Southern District Court’s personal jurisdiction over Mr Woolfenden.

“Mr. Woolfenden did not supervise or control the New York desk, and the few contacts he had with employees on that desk cannot be a “proximate cause” or “but for” cause of the CFTC’s claims and thus do not support personal jurisdiction”, the defense counsel has said.

The latest set of documents filed with the Court by the CFTC challenge the statements by the defense counsel. For instance, an email by Jeremy Woolfenden dated January 16, 2014, says that “but as long as you guys are good…I personally think it will make this desk succeed…it doesn’t matter now if we are in London or NY etc…”. Among the recipients of the email is David Walter, a TFS-ICAP options broker based in New York during the complaint period.

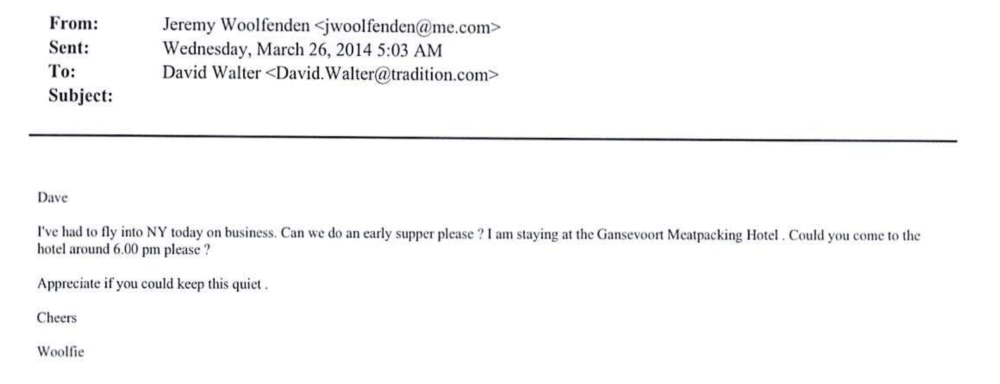

An email to David Walter by Jeremy Woolfenden from March 26, 2014, says:

“I’ve had to fly into NY today on business. Could you come to the hotel around 6pm, please?

Appreciate if you could keep this quiet”.

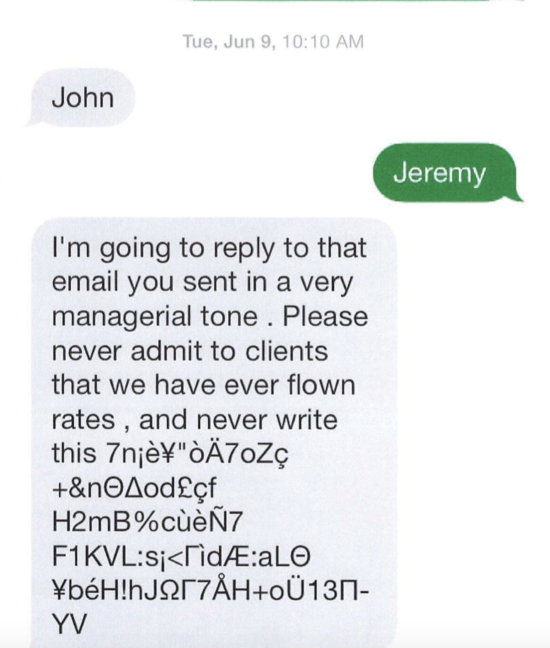

A July 15, 2014 Bloomberg chat is pretty elucidating as John Ward, a TFS-ICAP FX options broker based in NY at the time of the chat, tells Woolfenden:

“shall we be flying so much in a SEF market”.

In an email from July 22, 2014, Woolfenden says:

“the amount of calling needs to be more limited, there aren’t as many OFF SEF trades going through to make it believable”.

An excerpt from a phone chat between Woolfenden and Ward is rather straightforward: