New version of CQG desktop platform offers more partner widgets

Version 5.4 of the platform adds CME Group Commentary and CME Group Research widgets.

Provider of high-performance trading, market data, and technical analysis tools CQG has rolled out version 5.4 of its desktop platform.

The latest release of the solution offers more partner widgets. The platform has added CME Group Commentary and CME Group Research widgets. These, as well as widgets from other partners, can be accessed in the App Store widget group.

The latest release of the solution offers more partner widgets. The platform has added CME Group Commentary and CME Group Research widgets. These, as well as widgets from other partners, can be accessed in the App Store widget group.

Also, traders can now right-click on a working or filled order on the chart to get order actions. Right-click menus have been added to: Options grid, Positions widget, orders on chart.

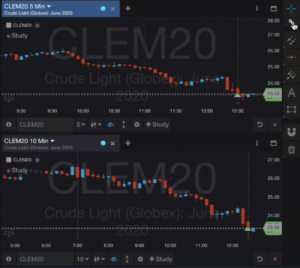

The platform also introduces global crosshairs. From the pointer tools toolbar, click the link icon beneath the Cursor pointer tool. This will activate crosshairs on all charts.

The platform also introduces global crosshairs. From the pointer tools toolbar, click the link icon beneath the Cursor pointer tool. This will activate crosshairs on all charts.

In addition, traders get the ability to activate parked orders for multiple accounts.

CQG has been updating its solutions on a regular basis. Thanks to version 5.2 of desktop platform, traders got the ability to launch the single symbol T&S widget from the Quotes group, single symbol section. It will open using the last used symbol. Traders can change the symbol using the symbol entry in the bottom bar, or use window linking.

Like the Time & Sales: Portfolio widget, traders can filter by bids, asks, trades, and traded volume as well as rearrange columns.

That version of the platform gave traders the ability to show more decimal points for all studies. In the Modify Study dialog, a new parameter is available for all studies to show additional decimal points.

A new chart type was introduced – Volume Candle.

Traders can also make use of DMIwADX study: ADX curve can now share scale with DMIu, DMId, and FFID.