New version of cTrader mobile app adds more chart types

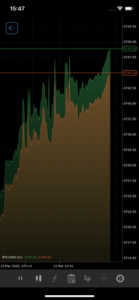

The latest version (3.11) of the cTrader Mobile app introduces Tick charts, Range and Renko bars.

Fintech expert Spotware Systems has just announced the release of a new version of its cTrader mobile app for Android and iOS-based gadgets.

The latest version (3.11) of the cTrader Mobile app introduces three chart types – Tick charts, Range and Renko bars. This way, all cTrader desktop chart types are now available in the mobile app. Tick charts, Range and Renko bars allow mobile traders to get absolute trading experience with a full spectrum of chart types for advanced technical analysis and better forecasting of future market movements.

Tick charts are based on a number of price movements – ticks, which they count and then print a new bar every time this number of ticks is reached. In general, tick charts provide information about market volatility.

Range bars are based on price changes and allow traders to better analyse market volatility. Traders choose their preferred price range and then a bar is printed every time this price movement is reached.

Renko bars highly focus on price movement and print a new bar once a certain amount of pips has been reached since the last bar closed. They help with better identifying support and resistance levels, as well as price patterns.

Also, the Fibonacci Retracement is now equipped with extra moving precision of the edges.

Additionally, the option to hide indicator titles allows for further space release for technical analysis purposes.

Finally, this version of the app allows traders to open a New Order screen while on the QuickTrade chart panel, in order to avoid closing full screen charts.

Let’s recall that the preceding version of the app added a raft of new indicators, such as Alligator, Hull Moving Average, and Polynomial Regression Channels.