New version of cTrader Web enables faster setting up of Price Alerts

Spotware Systems has updated cTrader Web Beta to version 3.1.

Fintech expert Spotware Systems has earlier today announced the release of the latest version (3.1) of cTrader Web Beta. The new cTrader Web 3.1 allows faster setting up of Price Alerts with extended controls and enables users to personalize their trading experience even further.

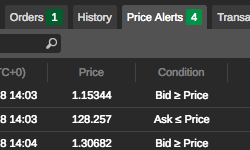

In addition to the Price Alerts controls located in main menu under Tools and in Line Study Tools (LST), traders can now quickly create and manage all Price Alerts using the Price Alert tab. This new tab has been added to the TradeWatch section.

In addition to the Price Alerts controls located in main menu under Tools and in Line Study Tools (LST), traders can now quickly create and manage all Price Alerts using the Price Alert tab. This new tab has been added to the TradeWatch section.

For more convenience, the cTrader team has also added Price Alerts button to the Active Symbol Panel allowing traders to create price alerts with a pre-selected symbol in the New Alert Dialog.

Another enhancement in the latest version of the platform enables traders to easily rearrange the order of their watchlists, symbols inside the watchlist and symbols between the watchlists.

Speaking of innovation concerning cTrader, let’s mention the recent rollout of cTrader Copy. The new copy trading service functions as a flexible investment program replacing cMirror.

The new copying model is based on Equity-to-Equity Ratio where the volume to be copied is defined according to the Strategy Provider’s and Investor’s Equity. The system automatically recalculates the volume of Investor’s positions to adjust it to equity to equity ratio, taking into account any allocated amount changes due to the deposits and withdrawals of both parties. This results in position sizes of the Strategy Provider and Investor being relative to the resources which each party has or has allocated to the strategy.

Earlier in November, Spotware released a new version (3.1) of cTrader Mobile Beta, with the app now offering traders more functionality for charting and order creation. For instance, in the new cTrader Mobile 3.1 traders can draw Ray, Equidistant Channel, and Fibonacci Retracement on charts, in addition to previously introduced horizontal, vertical or trend lines.