Saxo Bank’s OpenAPI to introduce new Ticksizes when placing FX orders

The OpenAPI, which is the backbone of trading platforms such as SaxoTraderGO, is set to add new Ticksizes.

Saxo Bank’s OpenAPI continues to evolve, with some changes set to be implemented during the weekend of November 24th.

Until now, FX instruments have only had one tick size which was defined by the field ‘TickSize’ under instrument details. After the change is implemented, the API will operate with three separate tick sizes when placing orders:

- TickSize: to be used for IOC and FOK orders.

- TickSizeLimitOrder: to be used for Limit orders.

- TickSizeStopOrder: to be used for Stop orders.

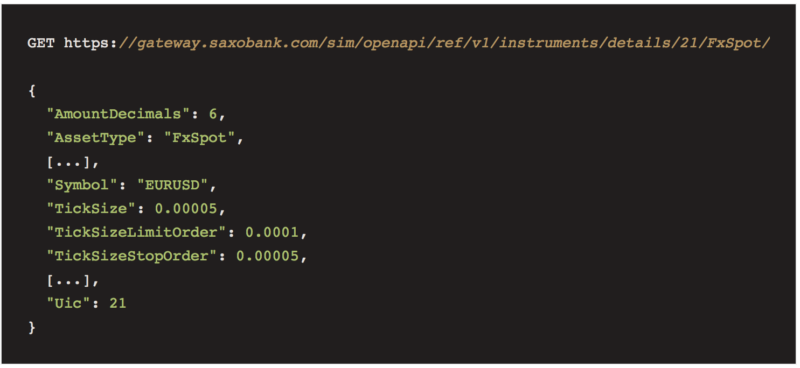

These two new tick size fields are already present when you query instrument details:

Next in line is a change concerning order types for FX instruments. In an effort to simplify order placement for FX instruments, the Saxo OpenAPI will be transitioning from one set of stop orders to another set of stop orders. This change is expected to be rolled out over the period of January 2019 – May 2019.

The OpenAPI is the backbone of trading platforms such as SaxoTraderGO. It offers access to all resources and functionality required to build a high-performance multi-asset trading platform, as well as better integration with Saxo Bank for partners and affiliates through a growing set of resources, such as Saxo’s On-boarding API.

Various clients can utilize the OpenAPI functionality in different ways.

Saxo Bank Premium, Platinum, and VIP clients can build their own portfolio analysis tool, or export their balances and positions into their preferred tool (Excel, R, etc). They can also develop a native application to keep up-to-date with market rates and their account performance. Furthermore, they can develop a targeted trader with an optimized UI for their particular trading style and instrument universe.

Saxo Bank Introducing Brokers and White Label Clients can integrate position/order/balance data from Saxo into their own client portal. The OpenAPI also enables them to build trading functionality into their existing client portal/website. They can also use the IB On-boarding API to simplify the on-boarding of new clients.

Developers of high-end trading and chart analysis platforms may enable their platform for Saxo’s substantial client-base, as well as get client portfolio information and tailor their analysis to the client’s product interests and situation. In addition, they can offer trading on client accounts via their software.

You can find out more about Saxo Bank’s OpenAPI by visiting the dedicated portal.