New version of NinjaTrader 8 platform adds options support for Kinetick, IQFeed, and Interactive Brokers

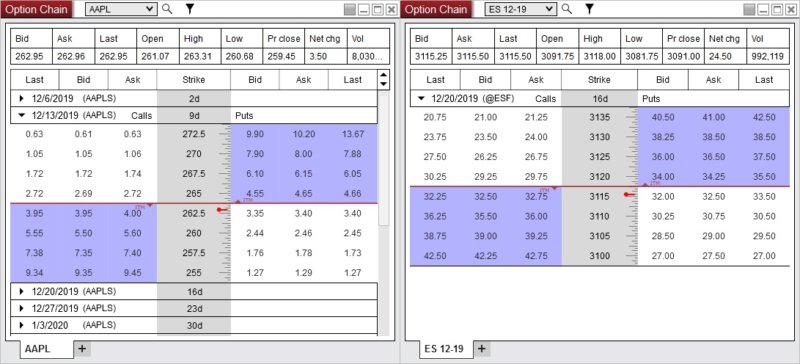

With Kinetick, IQFeed, and Interactive Brokers users of the platform can now access options on futures and equities.

NinjaTrader, a specialist in trade simulation, advanced charting, market analytics and backtesting, has rolled out a new version (8.0.20.0) of its NinjaTrader 8 platform.

The platform has added options support for Kinetick, IQFeed, and Interactive Brokers. Put otherwise, with Kinetick, IQFeed, and Interactive Brokers users of the platform can now access options on futures and equities. At this time these features are in beta.

The company notes that there is a required upgrade for TD Ameritrade NinjaTrader 8 users. Effective January 1, 2020, TD Amertrade will be increasing security by requiring a new authentication process. As a result, all users connecting through TD Ameritrade must upgrade to NinjaTrader 8.0.20.0 or newer to avoid a lapse in service.

NinjaTrader has been updating its platform regularly. In September this year, the company enhanced the platform with a raft of new features, including an FX Correlation window.

The FX Correlation window is used to display a correlation between multiple Forex instruments. Values close to 1 indicate movement in the same direction. Values close to -1 indicate movement in opposite directions. Values near 0 indicate no correlation.

That version of the platform also made Order Flow VWAP enhancements. Multiple features have been introduced to further increase customization on functionality. A Reset interval can now be set to Sessions, Weeks, or Months. Each standard deviation can now have color and opacity individually set.

Further, Order Flow Volumetric improvements have been introduced. Multiple features have been added to further increase customization and functionality. For example, the candlestick can now be centered on plot. Also, a Size filter property has been added to only include values greater than the threshold.