New version of NinjaTrader 8 platform enhances instrument search and AI Generate feature

The new quick search shows instant results allowing traders to quickly look for and change instruments without having to open a search.

NinjaTrader, a specialist in trade simulation, advanced charting, market analytics and backtesting, has released a new version (8.0.21.0) of the NinjaTrader 8 platform.

The new version of the platform enhances the quick search so that it shows instant results allowing traders to quickly look for and change instruments without having to open a search.

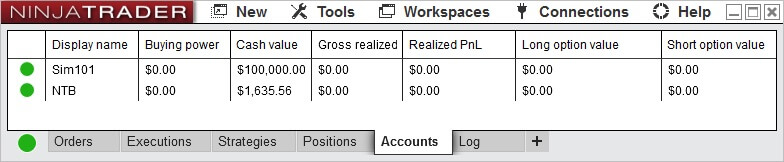

Also, ‘Show account numbers and balances’ setting has been added. It can be disabled to hide these values. Private account values can now be hidden from view by unchecking the ‘Show account number and balances’ property. This gives the ability to have additional privacy when sharing your screen or using NinjaTrader around others.

Also, ‘Show account numbers and balances’ setting has been added. It can be disabled to hide these values. Private account values can now be hidden from view by unchecking the ‘Show account number and balances’ property. This gives the ability to have additional privacy when sharing your screen or using NinjaTrader around others.

The AI Generate feature has now been expanded to allow the use of third party single series indicators.

Furthermore, Long/Short option values can now be displayed within the Accounts tab by right clicking on the Accounts grid, selecting Properties, and checking Long option value and/or Short option value.

NinjaTrader Brokerage customers now can view account Initial, Intraday and Net Liquidation account values. Multiple account data values (Unrealized PnL, Initial Margin, Excess Initial Margin, Intraday Margin, Excess Intraday Margin, Net Liquidation) will now be calculated and displayed for NinjaTrader brokerage customers using the NinjaTrader Continuum connection.

The platform has added support for PnL currency conversion of the Hong Kong Dollar. When trading instruments that have the Hong Kong Dollar currency (such as the HSI & MHI), the PnL will now convert to the accounts denomination.

The preceding release of NinjaTrader 8 added options support for Kinetick, IQFeed, and Interactive Brokers.

In September 2019, the company enhanced the platform with a raft of new features, including an FX Correlation window. The FX Correlation window is used to display a correlation between multiple Forex instruments. Values close to 1 indicate movement in the same direction. Values close to -1 indicate movement in opposite directions. Values near 0 indicate no correlation.