NRI SecureTechnologies unveils blockchain security monitoring service

The new solution detects and reports security vulnerabilities in information systems and services that use blockchain technology.

NRI SecureTechnologies, a subsidiary of Nomura Research Institute Ltd (TYO:4307), has earlier today unveiled its “Blockchain Security Monitoring Service”.

The new solution detects and reports security vulnerabilities in information systems and services that use blockchain technology. The first use will be as a monitoring service for smart contracts on Ethereum.

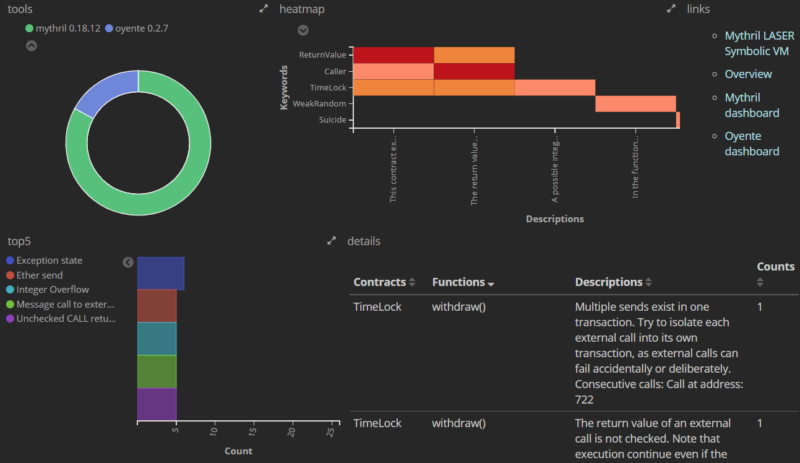

This service is implemented by introducing multiple scan tools in the security log monitoring service “NeoSOC” that NRI already offers. “NeoSOC” monitors the behavior of targeted smart contracts and notifies the company using this service when new vulnerabilities are identified. The company that receives such a notification can avoid an attack by stopping the use of the corresponding programs and system processes.

One of the newly introduced tools is “Mythril”, a smart contract security diagnosis and analysis tool that is offered by ConsenSys Diligence Inc., a blockchain security company. A feature of Mythril is that it can automatically diagnose the behavior of a smart contract and discover hidden vulnerabilities. NRI Secure has thus become the first development partner of ConsenSys in Japan.

Along with the increase in illegal intrusions into virtual currency exchanges and cyber attacks that exploit blockchain vulnerabilities, and the accompanying damage, cases of attacks that target smart contracts have been reported. Nomura explains that, therefore, it is necessary for the developers of smart contracts, and the companies that introduce them, to always be aware of information about security vulnerabilities and check whether a developed program could be the target of an attack.

In the future, NRI Secure will continue to work with ConsenSys and other finance technology companies within Japan and elsewhere to widen the range of application of this service and to make contributions in the area of security in the development of blockchain technology and for the businesses that use it.

Japanese companies have been among the first to embrace and develop new blockchain-based services. In May this year, for instance, Mitsubishi UFJ Financial Group Inc (TYO:8306) and Akamai Technologies, Inc. announced the development of a new blockchain service, to realize a payment processing platform with a capacity to process a million transactions per second and the ability to finalize transactions in less than 2 seconds.

The new service is set to be available from fiscal year 2019. It will leverage MUFG’s payments business expertise and the capabilities of an advanced blockchain technology implemented on Akamai’s global cloud delivery platform.