Eclipse CEO and founder Neel Somani announced that he will temporarily step back from his role at the company in light of renewed sexual harassment allegations against him.

India is set to postpone implementing caps on market shares for Unified Payment Interface (UPI) transactions, sources familiar with the matter told Reuters.

Robinhood Markets has turned a corner with its second consecutive quarterly profit, topping Wall Street estimates with a boost from higher interest rates and vibrant cryptocurrency trading.

“We’re proud to collaborate with SBI Digital Asset Holdings to make the Chiliz Chain the premier blockchain for sports and entertainment within Japan and expand our Fan Token offering through registered and authorized platforms.”

Ripple and XRPL Labs are now members in the Decentralized Recovery (DeRec) Alliance, joining other blockchain organizations including Swirlds Labs, developer of Hedera, and the Algorand Foundation.

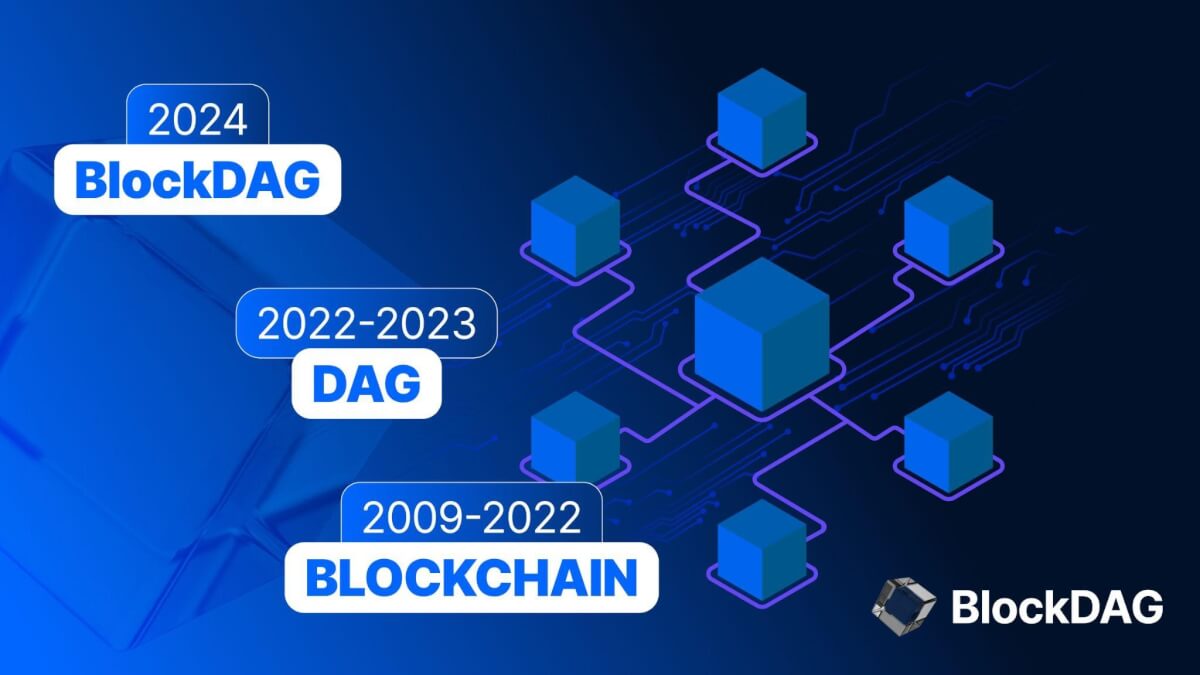

BlockDAG’s Revamped Roadmap Drives Presale to New Record of $24.3M Success while XRP & Dogecoin Anticipate Growth

Read More →The world of cryptocurrency is alive with hype surrounding technical breakthroughs and recent updates.

“As U.S. crude oil exports hit new records, commercial demand for our WTI-linked export contracts is also growing rapidly as global market participants manage their price exposure.”

The broker’s failure to identify its client’s trading as suspicious was “careless”, according to ASIC’s Markets Disciplinary Panel.

Based on research by S&P Global Intelligence, banks offering embedded finance outpaced peers on deposit growth, with a median sequential growth rate of 2.2% for banks, versus a decline of 0.8% for banks that did not.

The two award wins validate BDSwiss’ endeavors in the online trading sphere, especially when it comes to innovation, research, and education.

“Equity markets across the Middle East are flourishing right now, as asset owners look to leverage the benefits of wider share ownership.”

The Securities and Exchange Commission (SEC) has charged Rhode Island resident Ahmed Alomari and his entity, MCM Consulting, with securities fraud and other violations related to the promotion of at least five microcap stock issuers.

“We are delighted to provide Amwal Capital Partners with the technology they need to drive new efficiencies and automate their key processes, allowing them to make better-informed investment decisions and effectively manage their overall risk.”

“Chainalysis is excited to collaborate with Emirates NBD through its Digital Asset Lab, leveraging its data and solutions to facilitate safe and transparent digital asset services.”

“The combination of quantitative tightening, increased collateral supply, and current rates market activity shifted more assets from the Federal Reserve’s reverse repo facility to money markets. Retail money markets activity was strong as markets priced in less aggressive Fed rate cuts.”

Given the predominant daily uptrend, Amazon can be expected to rise further toward the next round resistance level 200.00,

Fed fights inflation with rates (hurting growth) while BoE weighs rates (impacting Pound) as strong USD benefits US consumers but hurts exporters and some countries.

AUDCAD currency pair can be expected to fall further toward the next round support level 0.9000.

Advertisement

India is set to postpone implementing caps on market shares for Unified Payment Interface (UPI) transactions, sources familiar with the matter told Reuters.

Robinhood Markets has turned a corner with its second consecutive quarterly profit, topping Wall Street estimates with a boost from higher interest rates and vibrant cryptocurrency trading.

“Securities Lending is a uniquely complex, and vital component of the broader Securities Financing markets that underpin the global financial system. In many ways, it is the first of the traditional capital markets ecosystems that rely on T-0, real-time settlement.”

Ripple and XRPL Labs are now members in the Decentralized Recovery (DeRec) Alliance, joining other blockchain organizations including Swirlds Labs, developer of Hedera, and the Algorand Foundation.

The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) has imposed a hefty fine on cryptocurrency exchange giant Binance for non-compliance with money laundering regulations. The action was the result of findings from a compliance activity conducted in 2023.

Bybit, one of the world’s top three crypto exchanges by volume, today announced an upcoming Initial DEX Offering (IDO) for Nulink (NLK)on its Web3 platform.

Marketing to a New Kind of Trader: (Without Alienating Your Main Audience) addresses the new challenges and opportunities faced by brokers amid spiking retail investor activity since 2021, which now accounts for nearly 25% of the total trading volume in the equities market.

FinanceFeeds spoke with Alex Knight, Head of EMEA, Baton Systems; Craig Stirling, Head of Securities Product at AccessFintech; Tomo Tokuyama, EVP Managing Director of FX at Trading Technologies; and James Maxfield, Chief Product Officer at Duco; to ascertain their perspectives on the challenges ahead.

It’s safe to say that the finance industry has faced its share of reputation crises over the years, from the 2008 financial collapse to the many scandals around irresponsible lending, political corruption, and even Ponzi schemes.

Advertisement

As sophisticated traders get younger and their expectations track their experiences, the bar for leading technology providers keeps moving up.

A progression from PSD2, PSD3 aims to bolster payment security and customer authentication, address PSD2 deficiencies, and enhance access to banking infrastructure for Payment Service Providers (PSPs). The final version of the directive is scheduled for publishing later this year, and if approved by the EU, will become law in 2026 following a transition period.

Resonance Security, a cybersecurity provider within the Web2 and Web3 ecosystems, has plans to accelerate its expansion following a $1.5 million pre-seed funding round co-led by Arca, Fabric VC, and Blockchain Founders Fund.

Explore the latest advancements in staking infrastructure as SSV.Network reaches $2 billion in Total Value Locked (TVL) and collaborates with Ether.Fi to enhance decentralized staking solutions.

Explore the latest advancements in staking infrastructure as SSV.Network reaches $2 billion in Total Value Locked (TVL) and collaborates with Ether.Fi to enhance decentralized staking solutions.

“We’re proud to collaborate with SBI Digital Asset Holdings to make the Chiliz Chain the premier blockchain for sports and entertainment within Japan and expand our Fan Token offering through registered and authorized platforms.”

ADGM’s progressive Capital Markets Framework, coupled with its familiar legal and regulatory frameworks, offers a conducive environment for fund managers to thrive while adhering to international standards.

On the 1st of May, 2024, FXIFY™ celebrated its 1-year anniversary, marking a significant year of growth and milestones.

Explore the innovative Megadrop platform on Binance, offering early access to new Web3 projects and a chance to earn unique rewards.

The report jointly presented by QuickNode and Artemis provides an in-depth analysis of the blockchain ecosystem’s evolution in the last quarter, particularly focusing on user activity, significant developments across different blockchain chains, and emerging trends in the web3 space.

Embark on the Future: Binance App Surges with 6.3M Downloads in 2024’s Dawn, Redefining Crypto Accessibility. Dive into the World of Web3 with Binance’s Intuitive Interface and Join Over 183M Users in the Financial Revolution. Trust, Security, and Limitless Possibilities Await.

Eclipse CEO and founder Neel Somani announced that he will temporarily step back from his role at the company in light of renewed sexual harassment allegations against him.

Trading software and liquidity services provider Finalto Asia Pte Ltd has appointed Suzuki Akihiko has as its newest head of Japan markets. Suzuki, who brings over two decades of experience in the financial sector, assumes his role effective immediately.

Erik Boekel has an extensive professional background encompassing regional responsibilities across Africa, the Middle East, and Europe.

A progression from PSD2, PSD3 aims to bolster payment security and customer authentication, address PSD2 deficiencies, and enhance access to banking infrastructure for Payment Service Providers (PSPs). The final version of the directive is scheduled for publishing later this year, and if approved by the EU, will become law in 2026 following a transition period.

FV Bank now lets clients deposit euros directly into USD accounts, streamlining international business banking and offering a wider range of deposit options for its global clientele.

PayRetailers Arg S.R.L.’s recognition as a PSP Aggregator by the Central Bank of the Argentine Republic enhances its payment services in Argentina, emphasizing efficient and secure solutions.