Plus500 buys more of its shares in line with share buyback program

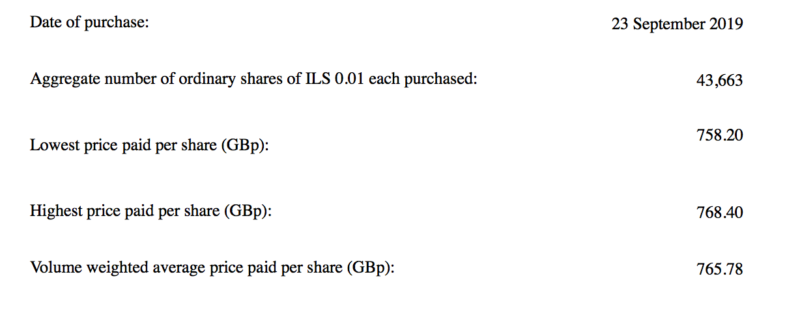

The brokerage purchased 43,663 of its shares on Monday, as it presses ahead with its share buyback program.

Online trading company Plus500 Ltd (LON:PLUS) presses ahead with its share buyback program, as indicated by the latest filings with the London Stock Exchange.

The company bought 43,663 shares on Monday, September 23, 2019, with the bolume weighted average price paid per share (Gbp) being 765.78.

The latest transaction means the remaining number of ordinary shares in issue will be 111,933,534 (excluding treasury shares), and the company will hold 2,954,843 ordinary shares in treasury. Therefore, the total voting rights in Plus500 will be 111,933,534.

During the period from September 16, 2019 to September 20, 2019, Plus500 bought back 308,649 of its shares. The brokerage bought a total of 198,813 shares during the period from September 9, 2019, to September 13, 2019, as FinanceFeeds has reported.

Under the plans unveiled on August 13, 2019, Plus500 will conduct a material share buyback program to purchase up to $50 million of its shares. The share buyback program will run to March 31, 2020 or, if earlier, the date of the announcement of the company’s preliminary results for the financial year to end-December 2019.