Plus500 registers steep rise in client acquisition costs in Q2 2018

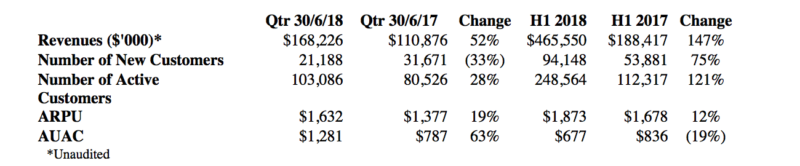

AUAC increased 63% from the same period in 2017 and reached $1,281 in the second quarter of 2018.

Online trading company Plus500 Ltd (LON:PLUS) has marked an increase in marketing spending in the second quarter of 2018, according to the latest metrics the broker has just posted.

The average user acquisition cost (AUAC) in the quarter to June 30, 2018 was $1,281, up massive 63% from the level of $787 registered in the equivalent period in 2017. Overall, marketing expenses for new customers, which is the principal expense of Plus500, has increased by 41% in the first half of 2018 in comparison to the first half of 2017. During the second quarter, the marketing spending increased as the Group focused on investing to recruit new customers in well-established jurisdictions.

However, the acquisition cost per new customer fell in the first half of 2018, with the broker attributing this to its optimisation initiatives.

With regard to the new ESMA rules, Plus500 noted that it had aligned with many of the proposed regulatory changes, prior to their coming-into-force.

During the first half of 2018, the broker started providing a process to allow its customers, upon their request, to change their regulatory status to a new categorisation as an EPC (elective professional client) in line with MIFID rules. Subsequently, approximately 5% of the Plus500’s EEA customer base has elected to become EPC to date, representing approximately 20% of Q2 revenues within the EEA. The categorisation process is progressing broadly in line with Plus500’s expectations.

The financial metrics for the first half of 2018 are robust, as revenues and profits benefited from trading activity, which was itself bolstered by various economic events and volatility of certain instruments such as cryptocurrencies. Plus500 notes, however, that the cryptocurrency hype has diminished.

Let’s note that, as per the unaudited results, net profit in the first half of 2018 amounted to $261.7 million, compared to $90.7 million in the first half of 2017. Revenues reached $465.5 million, up from $188.4 million in the first half of 2017.

During the six months to June 30, 2018, the adoption of Plus500’s mobile and tablet offering continued to grow and now represents 76% of the total revenues (H1 2017: 74%), with over 70% of the Group’s total trades executed on its trading platform being completed on a mobile device.