Plus500 reports results of meeting where exec directors’ pay was put to vote

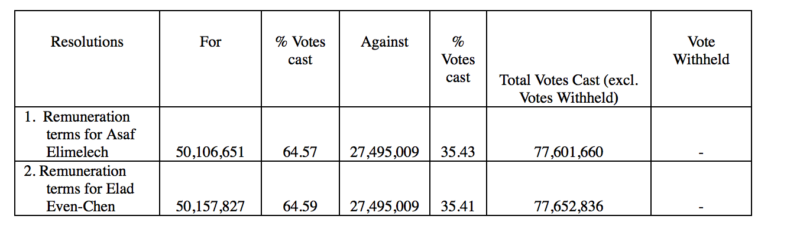

The proposed remuneration arrangements for Asaf Elimelech and Elad Even-Chen secured the approval of 64.6% of the votes.

Online trading company Plus500 Ltd (LON:PLUS) has announced that at the Extraordinary General Meeting (EGM) of the company held on February 20, 2020, all resolutions were duly passed.

As FinanceFeeds has reported, the main topic of discussion at the EGM was the pay of Asaf Elimelech, the Chief Executive Officer and an Executive Director, and Elad Even-Chen, the Chief Financial Officer and an Executive Director of Plus500. The proposals were amended in February, with the LTIP award for the directors revised.

Today, the proposed remuneration arrangements secured the support of 64.6% of the votes. That means that 35.4% were cast against the proposals.

The Board of Plus500 notes that there have been a number of votes (more than 20%) cast against Resolutions 1 and 2. The Board engaged with shareholder bodies and selected shareholders throughout the process and took into account their feedback and amended the terms of remuneration arrangements accordingly.

The Board insists that it takes these votes seriously, and will continue to consider shareholder feedback to ensure it is better understood and implemented as appropriate. The Board also reiterates its commitment to achieving the highest governance standards.

Let’s recall that, under the amended proposals unveiled in February, the company will grant to each of Mr Even-Chen and Mr Elimelech an LTIP award with an aggregate value of up to NIS 1,000,000 (approx. USD 285,000). This is down from the previous proposal of an LTIP award of up to NIS 2,550,000 for each of Mr Even-Chen and Mr Elimelech.

Further, under the revised proposals, the company will grant to each of Mr Even-Chen and Mr Elimelech a share appreciation right in the amount of NIS 2,500,000 (approx. USD 715,000) vesting after three years from the date of grant, with a maximum payout amount of NIS 7,500,000 (approx. USD 2,145,000). Under the preceding proposal, each of them would have been granted a share appreciation right in the amount of NIS 2,750,000 (approx. USD 786,000) vesting after three years from the date of grant, with a maximum payout amount of NIS 11,000,000 (approx. USD 3,144,000).