5 Trump tweets that moved the market

Charlotte Day of Contentworks takes a close look at how Donald Trump’s tweets and the effect on the market are correlated

Since Twitter’s inception, world leaders have taken to the social platform to push agendas and manoeuver their political ideas. Twitter is frequently used by politicians to address the electorate in order to keep them up-to-date on party stances, achievements and sometimes to fling mud at the opposition party. For the most part, these political leaders use the platform in a wise fashion.

Political figureheads using Twitter include:

- Benjamin Netanyahu – Prime Minister of Israel

- Angela Merkel – Chancellor of Germany

- Vladimir Putin – President of the Russian Federation

- Dmitry Medvedev – Prime Minister of Russia

- Nicolás Maduro – President of Venezuela

Then Donald J. Trump threw his hat into the arena. And everything changed.

The 45th President of the United States of America used his Twitter account like a cudgel. While some people may find a barrier of entry into political discourse, President Trump reached out to anyone with a Twitter account by using the platform as his primary channel of communication.

President Trump tweeted directly to opponents, private companies and even entire countries with a brash and uncensored tone. While his political counterparts toed-the-line, Trump made it clear where he stood on a matter. It’s therefore perhaps no surprise that his Twitter feed has moved markets.

Should Investors Care About Trump’s Tweets

Love him or hate him, investors would be wise to heed Trump’s tweets. There have been studies that measured the degree his tweets moved company stock prices and increase trading volume and volatility.

Plus, holding the position as the President of the United States, means he can influence laws, policies, trade tariffs, and government contracts. With this power at Trump’s disposal, a tweet about a specific company may hold meaning concerning the future of its fundamentals.

Here are 5 Trump Tweets that moved the markets:

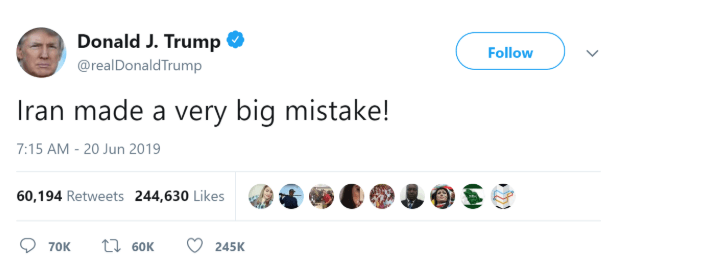

1. Global Oil Prices

Back on June 20, 2019, President Trump tweeted “Iran made a very big mistake!”

This was in reference to a U.S. spy drone being shot down by Iran. The drone was taken out of the skies while it was over the Strait of Hormuz.

The drone and attacks on two oil tankers near the Gulf of Oman a week earlier definitely contributed to price speculation on oil, but oil prices saw a price spike of 5% hours after the tweet from President Trump.

According to Bloomberg, West Texas Intermediate rose $0.56 to $57.63 a barrel while Brent for August climbed $2.63 on London’s ICE Futures Europe Exchange ending at $64.45 a barrel.

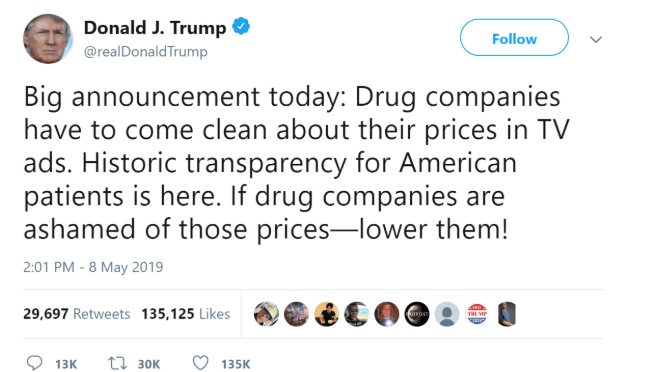

2. Pharmaceutical Stocks

President Trump’s tweets sometimes have a delayed effect.

Back on May 8, 2019, Trump tweeted:

As we saw on July 9, 2019, U.S. District Court overturned President Trump’s requirement that drug makers needed to be transparent and list drug prices that exceeded $35 a month in TV ads.

This ruling lead to biotech and pharmaceutical stock increases. iShares Nasdaq Biotechnology (IBB) exchange-traded fund rose 1% and the Invesco Dynamic Pharmaceuticals (PJP) ETF increased by 0.9%.

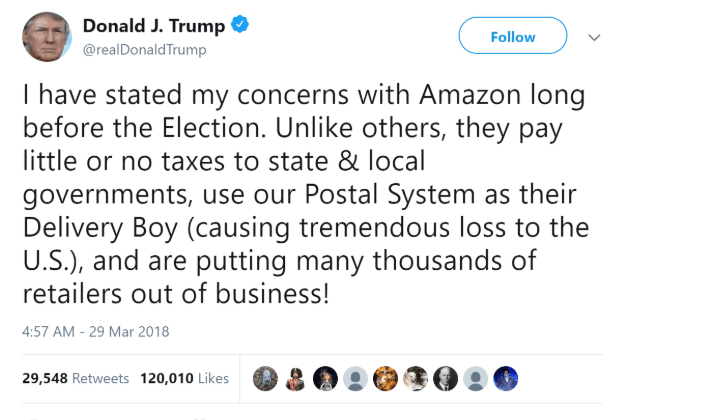

3. Amazon.com

Last year President Trump released a tweet on March 29, 2018, sending traders to the market. The sentiment induced high volatility for Amazon, seeing its shares drop more than 3.8% the following day.

The attack on the company was due to Trump’s claim that Amazon paid “little or no taxes”, and was putting local retailers out of business. The tweet sent fear into investors who postulated that the President might raise taxes on the e-commerce giant.

Hours after the price drop, Amazon’s shares recovered some of the lost ground.

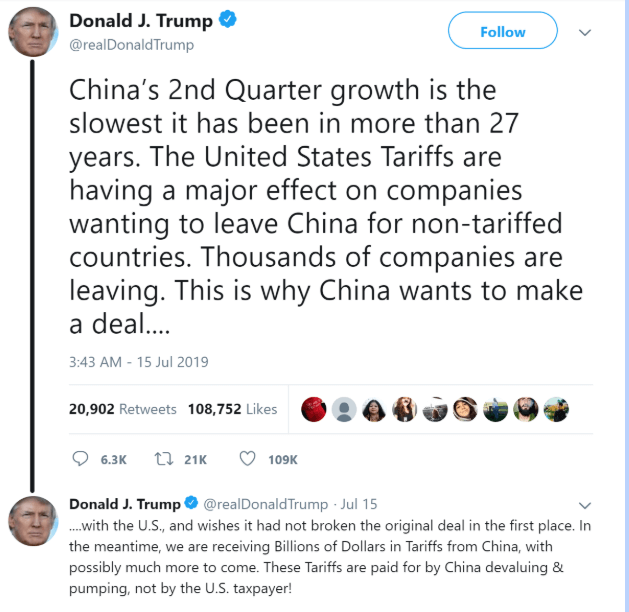

4. China, Taxes, and Soy

China has always been a hot topic for the Trump administration. Trade wars, spying software in Huawei phones and Chinese sanctions against the U.S. have all been brought to the table.

As more news floods in every day concerning Trump’s proposed tariffs on China and how that tax won’t supposedly get passed down to American consumers, it’s hard to pinpoint an exact affect his tweets had on the market.

One of Trump’s tweets did seem to at least play a substantial part in soybeans though.

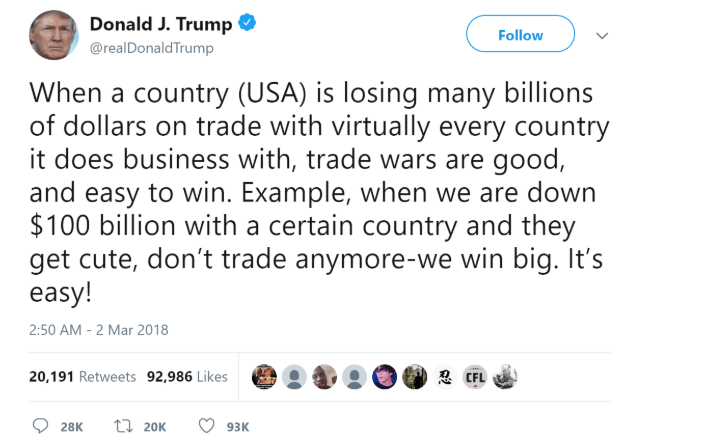

Trump tweeted out on March 2, 2018, and three months later a 25% tariff on nearly $35 billion worth of Chinese imports was levied. This resulted in Soybean futures marked for November 2018 to drop to a decade low of $8.26 per bushel.

In Conclusion

It’s easy to see that Trump’s tweets do affect the market, but the impact is as short-lived as any other news coverage. While both positive and negative tweets can nudge the market for a trading day, a correction is usually on the horizon to set the market back on track. Contact Contentworks today for Twitter management, daily reporting, news and monthly outlooks which follow all the latest happenings in the finance world.