Advanced Markets and Fortex Launch MetaTrader5 White Label Programs

“We have built great momentum in extending supreme Advanced Markets liquidity to MetaTrader5 over our flagship Fortex Bridge, OMX. As a result, we are ready to expand the offering with a line of MT5 White Label packages” – Natallia Hunik, Global Head of Sales, Advanced Markets & Fortex

Institutional FX liquidity provider and Prime of Prime brokerage Advanced Markets, in cooperation with Silicon Valley based Fintech provider Fortex today announced the launch of their MetaTrader5 White Label program.

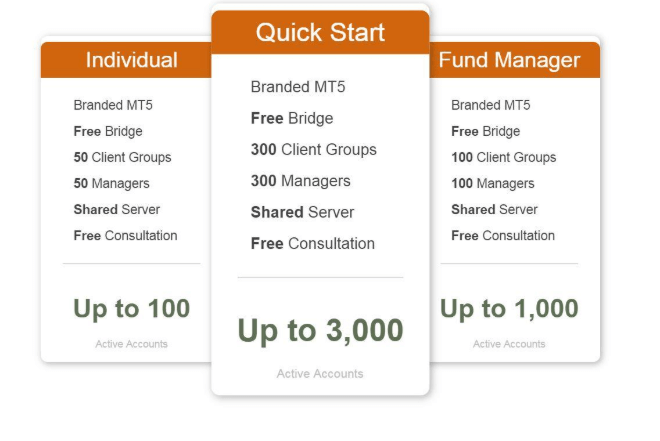

Advanced Markets is a 100% STP / Agency broker and an FCA and AFSL license holder. The company offers its services to wholesale / professional clients only. Advanced Markets provides superior, aggregated Tier 1 bank, non-bank and ECN liquidity in FX, Metals, Energies and CFDs at extremely competitive terms. Through its MetaTrader 5 White Label program, Advanced Markets will be distributing its liquidity to qualified clients. These institutional clients can sign up for the “Fund Manager”, “Individual” or “Quick Start” package. In addition to the MT4 brokerage packages, the service bundles are now also available on the MetaTrader5 (MT5) platform.

MetaTrader 5 White Label programs

The “Start your own brokerage” packages by Advanced Markets & Fortex provide commercial access to the fast growing, and high margin, FX market space with its 24 hours-a-day revenue opportunity. Through this all-inclusive solution, new market entrants, who are looking to become Forex brokers, can onboard and service their clients easily. Furthermore they can create their own revenue streams and leverage cutting-edge technology from Fortex alongside 100% STP liquidity from Advanced Markets. On top of that they benefit from the combined, immense experience of the business development and consulting teams.

Start Your Own Brokerage Packages

Fully-hosted, and fully-integrated, “start your own brokerage” packages include a branded MT5 (and/or MT4) platform. The platform is hosted in the world’s top-grade NY4 and HK3 Equinix datacenters. Moreover, the brokerage packages include a web MT5 platform, a bullet proof Fortex MT5 (and/or MT4) bridge OMX and a Fortex XBook aggregator.

The White Label program also comes along with

- Net and ticket-based execution

- Full “depth of market” visibility

- White glove customer service

- Access to no-last look liquidity from top FX banks and the proprietary back office tools

- Fully-fledged Fortex platform for clearing account management

Value-adds include complete access to the expertise of the industry’s top FX consultants. This is in other words a talented team that has already helped over 300 new FX brokers navigate the process of starting their own brokerages. In addition, new market participants will certainly enjoy the freedom to choose website development and marketing tools. Moreover, they get access to other tools to help grow their business and stay ahead of competition.

Natallia Hunik, Global Head of Sales at Advanced Markets and Fortex commented:

“We have built great momentum in extending supreme Advanced Markets liquidity to MetaTrader5 over our flagship Fortex Bridge, OMX. As a result, we are ready to expand the offering with a line of MT5 White Label packages. With MetaTrader5, we help brokerages to tap into the potential of financial markets outside of FX and CFDs as well as enjoying more flexibility in settings, full market depth and a choice of net-based and ticket-based order execution.”