ATFX launches new CFD products for its clients

ATFX has added US Natural Gas Futures Contracts CFDs and digital asset Cash/US dollar CFDs to its range of tradable products for retail customers

ATFX launched new trading products for its clients in South East Asia, Latin America and the Middle East. The new tradeable products are:

- US Natural Gas Futures Contracts CFDs

- Digital asset Cash/US dollar CFDs

ATFX added the new CFDs to its product line-up because of a high demand from its clients. As an award-winning broker, ATFX is known for its outstanding trading and customer services. It will continue to add new products to its ever-growing portfolio based on market trends and client requests.

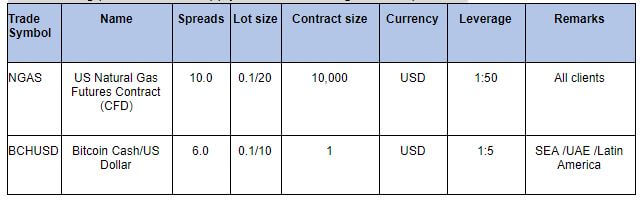

The following parameters will apply for clients trading the new products

ATFX now boasts over 100 tradeable products and the company intends to add more instruments to its portfolio. ATFX clients can trade over 43 currency pairs including Forex majors, minors and exotic pairs. The broker also offers CFD products for top digital assets, stocks, indices, and commodities.

The fact that the new products are traded as CFDs allows traders to speculate on prices both rising and falling. CFDs make it easier to short instruments without incurring significant margin requirements as they would when trading the underlying assets.

Retail traders don’t have the same resources as institutional investors but will find CFDs provide access to the same markets. The ability to trade the same market’s levels the playing field when it comes to asset diversification.

ATFX would like to warn its clients that trading CFDs and other leveraged products carries risk and that they could lose amounts greater than their deposit.

ATFX will continue to add further trading instruments in 2020, aiming to provide the best possible trading experience for traders and investors.