Bank of Canada January Rate Meeting: What can we expect?

Alejandro Zambrano Chief Market Strategist at ATFX and Investingcube.com examines the outcome of the most recent meeting held by the Bank of Canada and resultant movements in currency against the Canadian Dollar

By Alejandro Zambrano, Chief Market Strategist at ATFX and Investingcube.com.

The Bank of Canada and the Canadian Dollar will come into focus on January 22, when the Canadian central bank will hold its first-rate meeting for the year. The BoC lifted its interest rate to 1.75% in October 2018 and left it there since then. At this month’s rate meeting, economists anticipate the rate to remain unchanged. However, until recently that was not the case. For most of 2019, economists predicted the Canadian central bank to reduce rates, as many of its peers, however, it never happened.

A rate cut today looks even less likely, and it is possible that the continued strength of the Canadian economy and high inflation will leave the bank rate unchanged for longer, and thereby continue to support the Canadian Dollar.

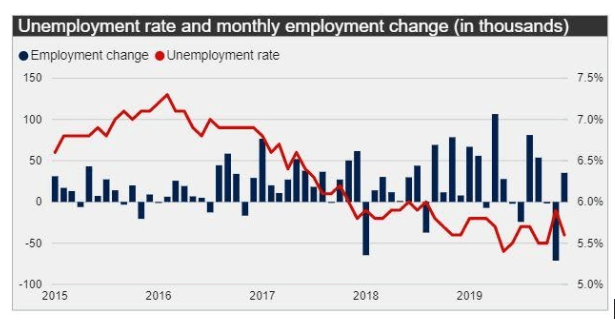

Canadian Unemployment Rate declines and Inflation Remains High

The latest labor market report out of Canada showed good improvement. The Unemployment rate dipped to 5.6% vs. the 5.8% projected, and the unemployment rate is nearing the multi-year low of 5.4% from June 2019. These are levels that the central bank considers to be very low.

Unemployment rate

Source: Statistics of Canada

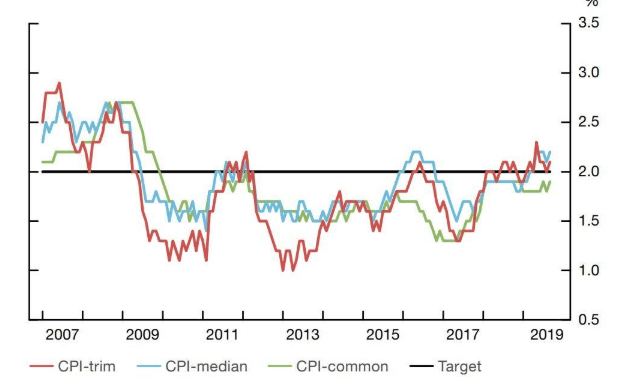

Inflation remains high, with the headline annual inflation is at 2.2%, and core inflation at 1.9%. At the December meeting, the bank said, “CPI inflation in Canada remains at target, and measures of core inflation are around 2 percent, consistent with an economy operating near capacity.” The comment makes it clear that the economy and their interest rate are exactly where they would like to have it.

Canada Inflation Measures

Source: BoC.

In their GDP output models, they also estimate that the economy is near full capacity, with the GDP gap being estimated to be between -1% to 0%. The level of the output gap has historically been a very good indicator of actions by the central bank.

In the latest rate meeting, the BoC also said their biggest headache was global trade wars, however, tensions have decreased and the US has scaled back some of their tariffs on Chinese goods, and no longer considers China to be a currency manipulator. It, therefore, looks unlikely that trade wars tensions will pick up any time soon.

Overall, the current economic conditions warrant no changes to the central bank rate. If inflation continues to remain persistently high, we might even see a rate hike, which could further support the Canadian dollar. Overall, I remain bullish the Canadian dollar vs. currencies such as the Euro, NZD, and JPY on good technical setups.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.