Cryptocurrencies: Fad or fundamental change?

Bitcoin may turn out to be the pioneer, the ‘proof of concept’ that demonstrates that virtual currencies are reliable and secure. As an investment asset, however, it has nothing but sentiment backing it up, and its use in the drug trade and other underworld activities leaves it vulnerable to government sanctions, says Monique Wong of British investment bank Coutts & Co

By Monique Wong, Multi-Asset Investment Manager at Coutts.

A sudden rise in value has seen investors take an interest in electronic cryptocurrencies. But while we see long-term benefits from the technology involved, there are too many unknowns for us to include virtual currencies in our investment strategy.

A new way to spend

Bitcoin is the most established of what are known as ‘cryptocurrencies’, getting their name from the heavy-duty cryptography that is used to verify transactions. There are now hundreds of cryptocurrencies in circulation, thousands if you include those that have gone dormant, but bitcoin was the first and remains the most popular.

Cryptocurrencies are a type of money that exists only electronically – there are no notes or coins available – but can be used to buy things online or on the high street in a similar way you might use a credit card.

Getting hold of bitcoins isn’t difficult. You can find companies selling them on the internet, for example. You can even get them from something like a cash machine, called a ‘Satoshipoint’ (named after Satoshi Nakamoto, the pseudonymous and mysterious creator of bitcoin) popping up around cities the world over.

The appeal of convenience

The reach of bitcoin is spreading. A growing number of small-scale retailers – often in the tech industry – will accept them and some mainstream companies have started accepting them as well, including Microsoft, Dell and PayPal. Business woman Michelle Mone is one of a group of entrepreneurs behind a Dubai apartment complex that will let residents buy their apartments and pay their rent in bitcoins.

While it doesn’t have a lot of advantages over other currencies, using bitcoins can be more convenient for some people as a quick, low-cost alternative to international exchange, for example. Paying in bitcoin means avoiding the chain of transactions – and associated delays and charges – that are part of converting money into different currencies.

Aside from this, cryptocurrencies offer users a degree of anonymity when making online transactions. While there may be good reasons for this, it has also attracted criticism as a vehicle of exchange for black markets in drugs and a mechanism for money laundering and tax avoidance. Some believe that this will limit the growth of cryptocurrencies as governments crack down on these anti-social aspects.

The bitcoin gold rush

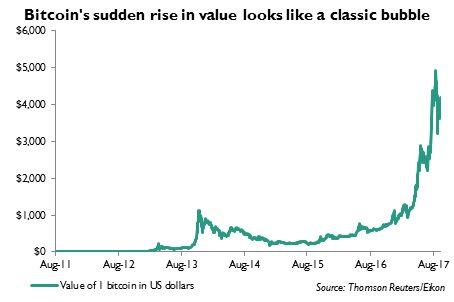

In recent months, bitcoin and other cryptocurrencies have been making headlines as a potential investment asset. In the last 12 months, the value of a bitcoin has gone from around US$600 to about US$4,200, having peaked at about US$5,000 earlier in the year.

Rival cryptocurrency Ether followed a similar trajectory, going from US$8 at the beginning of the year to over US$300 at the time of writing, with a peak of nearly US$400 along the way.

These kinds of return were always going to attract attention, and novelty value has also helped to raise the profile of cryptocurrencies. They are new and exciting and their emergence in the world of tech start-ups, computer message boards and cyberpunk hacker culture gives them a futuristic aura.

But you shouldn’t mistake these ephemeral characteristics for a strong investment story. At Coutts we base investment decisions on fundamental data, and bitcoins do not possess the metrics we would look for to gauge its underlying value. As far as we can see, these returns are based on pure speculation about their future potential, with no hard data to back it up.

Regulations are another barrier to investment. Cryptocurrencies are unregulated as securities in the EU, and therefore the UK, and regulated investors like Coutts aren’t permitted to invest in non-regulated assets. In addition there is no protection for individual investors against scams, hacks and theft.

A signpost for future change

But cryptocurrencies are a very interesting development in the world of finance. They may well point to significant changes to come in the way we spend money, as well as other applications. Understanding the technology that they are built on also provides clues as to the importance of their development and where the investment opportunities might be in the future.

One key area of innovation is a piece of software that sits behind cryptocurrencies called blockchain.

Unlike traditional currencies that are controlled by national central banks, cryptocurrencies have no central authority overseeing their integrity. Instead, they rely on a ‘peer-to-peer’ network of computers all talking to each other with no single centre to verify transactions and make sure each coin is genuine.

In simple terms, blockchain is a way of keeping track of every transaction that an individual unit of a cryptocurrency has been part of. Each transaction is coded into a ‘block’, recording how much of the bitcoin was exchanged and the bitcoin addresses of the payer and the payee. These blocks are linked together into a chain that stays with the coin as it moves from owner to owner. This means every virtual coin comes bundled with a chain of information authenticating its history.

The transactions are verified using what is called public-private key cryptography. The parties in a transaction exchange public keys to initiate a transaction, then use their private keys to verify it, at which point the block in the chain is written.

The cryptography is what keeps the blockchain secure. The block can’t be amended without both the public and the private key. And because the blockchain is held across a network of computers, rather than centrally, no single person can change it without everyone knowing.

These elements combine into a powerful combination – an independent virtual unit of exchange where transactions can be securely verified.

What is the future of cryptocurrencies?

With so many ways to securely spend traditional money, the question has to be: why does the world need cryptocurrencies?

One common use for them is as a way to send money overseas. This has the potential as a ‘disrupter’ to traditional foreign exchange services.

Commercial banking is another obvious application. Blockchain technology based on the Ethereum platform is being investigated by banks such as JP Morgan Chase as a way to manage derivative transactions and by the Royal Bank of Scotland for a clearing and settlement mechanism.

Central banks have also shown an interest in creating their own electronic currencies, which may have particular advantages for the wholesale finance market and as a way of controlling the money supply. And some large internet retailers – such as Amazon or eBay – may want to create currencies that they can use as an efficient way of managing gift tokens or credit notes.

Outside of finance, blockchain technology has potential applications where keeping secure records is important. Examples include health records that can be shared between health providers, or in tracking ownership of ‘virtual’ assets such as music or video files as a way of preventing piracy.

What next?

Bitcoin may turn out to be the pioneer, the ‘proof of concept’ that demonstrates that virtual currencies are reliable and secure. As an investment asset, however, it has nothing but sentiment backing it up, and its use in the drug trade and other underworld activities leaves it vulnerable to government sanctions.

In our view the development of blockchain technology is a far more interesting area to watch than the current gold rush on cryptocurrencies. This new technology has the potential to disrupt any field where there’s the need for secure, transferable records. For us, this is where the real story of bitcoin begins.