Help traders avoid large capital losses with Autochartist’s new retention tool

The tool is available in the form of a JSON API as well as an indicator in MetaTrader 4 & 5, and works independently of the Autochartist Market Scanner and can be used for any trading style; technical, statistical, macro-economic, and fundamental

Autochartist is proud to announce their new innovative tool that allows brokers to extend traders’ lifespan by creating transparency with regards to how much capital is being risked on each trade.

The tool is available in the form of a JSON API as well as an indicator in MetaTrader 4 & 5, and works independently of the Autochartist Market Scanner and can be used for any trading style; technical, statistical, macro-economic, and fundamental.

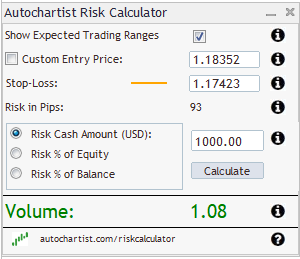

Autochartist Risk Calculator directly addresses a broker’s need to prevent traders from losing large amounts of capital. It allows the trader to set the amount of money they are willing to risk on a trade along with their desired entry and exit levels, and provides them with the correct trading volume they need to trade in order to stay within their risk tolerance.

Traders over-expose themselves due to two main reasons. Firstly, they use large stop-losses for longer term trades without adjusting their position size – thereby exposing themselves to greater losses. Secondly, many traders don’t understand that a 1 pip move on EURUSD is not worth the same as a 1 pip move on USDJPY, and end up being over-exposed in their portfolios.

The Autochartist Risk Calculator is an invaluable tool to help traders limit their losses.