IG Group launches IG Smart Portfolios

IG Group further diversifies offering and bolsters investment cost transparency via rollout of model investment portfolios constructed by IG using asset allocation insights from BlackRock.

Electronic trading major IG today launches IG Smart Portfolios, a range of model investment portfolios constructed by IG using asset allocation insights from BlackRock.

Ian Peacock, Head of UK and Ireland at IG Group, said:

“Our research shows that many investors are confident handling their own investment choices, but even so, a number are still being blindsided by fees. Hidden charges materially eat into investment returns and it is crucial that providers are transparent about all fees upfront, so that investors know the exact costs they will incur. As we join the digital wealth management industry, we are keen to show that a low cost online service leads to greater consumer control and clarity, without compromising at all on quality. There will be no hidden fees when you invest with IG Smart Portfolios, meaning our client’s investments will work harder for them. Every charge an investor may incur is fully disclosed prior to opening an account and at all times while they invest with IG.”

IG Smart Portfolios

IG Smart Portfolios are constructed by IG using iShares exchange traded funds (ETFs). The five risk-rated portfolios are constructed by IG based on asset allocation insights from asset management company BlackRock. The ETF-based portfolios are rebalanced and continuously monitored by IG’s portfolio management team to respond to market conditions, delivering diversified, risk-assessed returns for minimal cost.

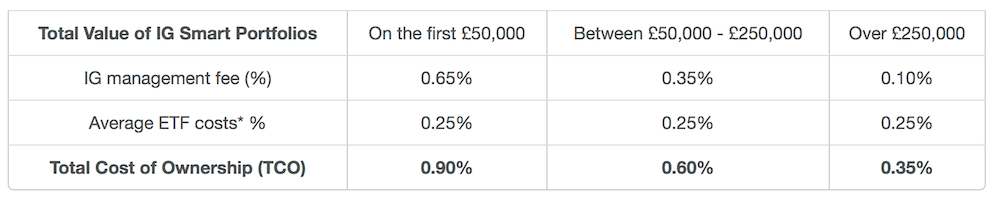

The low cost of ETFs, along with with IG’s low management fees, are set to help maximise returns in the portfolios for investors. There are no set-up, dealing, rebalancing or exit fees. Investors will get complete transparency on costs of the portfolios, with no hidden charges. Investors see the total annual cost of their investment which includes both the platform fee and the underlying portfolio costs. The platform also allows clients access to fractional shares of ETFs, ensuring their money is fully invested.

You can check out the fee structure of IG Smart Portfolios below:

Market opportunity for online investing

The launch comes after IG Group’s development of a market-leading share dealing offering in September 2014, and the introduction of its self-invested personal pensions (SIPPs) offering in May last year. These developments are part of the business’s strategic goal of providing a comprehensive suite of products to investors and traders in the UK.

Research undertaken by IG on investor demands shows a substantial market opportunity for online investing, with half of investors (52%) currently preferring to manage their investments online and four in five (83%) saying they could be persuaded to switch online in the future.

Peter Hetherington, CEO of IG Group, comments,

“The launch of IG Smart Portfolios is an important step in the development of our investments offering. We see a huge opportunity in online investing, with strong demand from investors for online solutions and transparent fees. Through our partnership with BlackRock, and building on our long-standing online trading technology expertise, we believe we have created a best-in-class offering for investors who are seeking an engaging digital low cost solution to their wealth management.”