Invast Global becomes AFMA member and commits to the FX Global Code

Invast Global has demonstrated strong support for the concept and spirit of the FX Global Code of Conduct since it was established in May 2017.

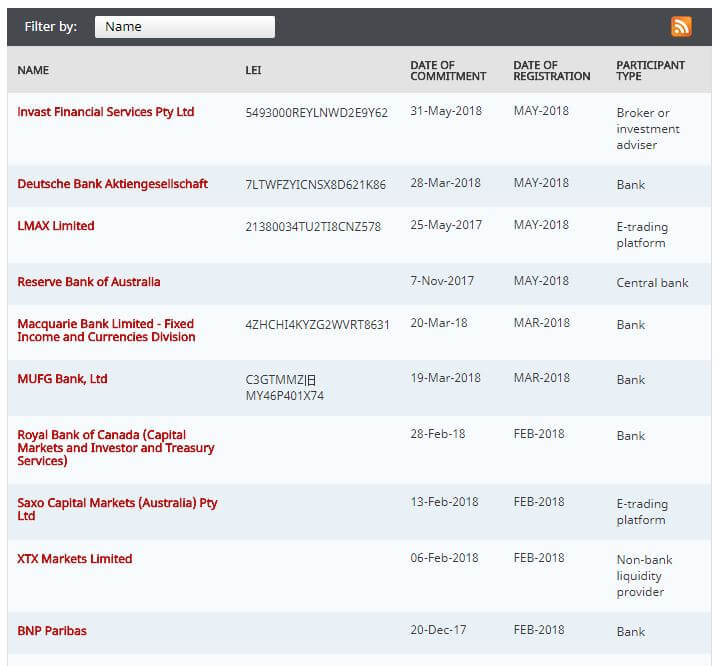

Leading boutique prime broker, Invast Global, has today signed and issued a Statement of Commitment to the FX Global Code of Conduct. The announcement comes shortly after the firm was officially voted in as an institutional member of the Australian Financial Markets Association (AFMA).

The Australian Financial Markets Association (AFMA) was formed in 1986. Today AFMA is the principal industry association promoting efficiency, integrity and professionalism in Australia’s financial markets – including the capital, credit, derivatives, foreign exchange and other specialist markets.

According to the Global Foreign Exchange Committee, an official forum of international central banks and private sector market participants, the purpose of the Global Code is to promote a robust, fair, liquid, open, and appropriately transparent market in which a diverse set of market participants, supported by resilient infrastructure, are able to confidently and effectively transact at competitive prices that reflect available market information. The Code was developed through a partnership between central banks and market participants from 16 jurisdictions around the globe.

Invast Global has demonstrated strong support for the concept and spirit of the FX Global Code of Conduct since it was established in May 2017. As an STP non-bank prime broker, Invast Global transparently passes pricing and execution from their pool of bank and non-bank liquidity providers (LPs) through to their broker and hedge fund clients. Invast Global has declared a committed to protecting the interests of its clients above all else.

On July 18th 2017, Invast Global hosted an exclusive event in Sydney to promote the FX Global Code. Dr Guy Debelle, Deputy Governor of the Reserve Bank of Australia, who has been the leading visionary and main architect of the Global Code was the special guest speaker.

Gavin White, Chief Executive Officer of Invast Global, stated, “a fair, transparent and robust market is a central tenet of a strong and progressive industry. Clients of all sizes need to be able to rely on it. It’s not something we should simply aspire to, it is essential. Invast Global is proud to be taking a leadership role in keeping the FX Global Code of Conduct at front of mind amongst industry participants. We look forward to working closely with AFMA and the Global Foreign Exchange Committees in future. Our clients can rest assured that fairness and transparency are values that Invast Global has been built around and which we commit to upholding going forward. ”