Leverate adds Autochartist to new Activ8 platform

Activ8 users will have access to Autochartist’s trading opportunities including Chart and Fibonacci Patterns, as well as Key Levels

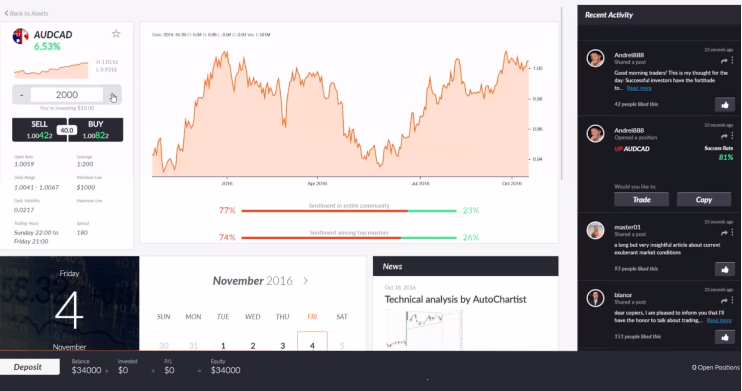

Leverate recently announced the integration of the Autochartist service to their new Activ8 trading platform. Activ8 comes with tools that will appeal to traders of all experience levels, all housed in one platform.

This integration allows Autochartist content to be used directly by sales, marketing and retention teams in order to engage with customers in a more meaningful manner. This type of integrated content solution is of massive benefit to Activ8 brokers and will give Leverate’s broker customers a unique edge over competitive platforms.

Activ8 users will have access to Autochartist’s trading opportunities including Chart and Fibonacci Patterns, as well as Key Levels. In addition, Autochartist is integrated with the Activ8 CRM system which allows for both improved user experience and automatic transfer of trader information to sales and retention teams.

Traders will not need to leave the trading platform, open other browsers, or run applications or third-party set-ups as Autochartist’s technical setups can be found in the news section making analysis of trades quicker and easier.

It’s clear that this integration fulfills both Autochartist and Leverate’s primary goals which are to develop technology that optimizes processes for brokers and their clients. With this partnership clients are presented with valuable trading opportunities and are able to execute trades from one place. A functionality which will see increased broker productivity and profitability.