Spotware Celebrates 10 Years of Fintech Innovation

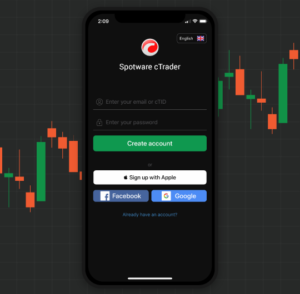

Ten years ago, innovative software company Spotware Systems launched the cTrader trading platform, a system which has continued to be a driving force in empowering brokers globally.

It has now been 10 years since Spotware, and soon after its flagship product – cTrader, have entered the market and became the epitome of Fintech innovation.

10 years of continuous growth, development and updates, a journey that began from a new-born trading platform with its Traders First™ idea at the core and which has led to one of the most sought-after, trader-chosen products out there, boasting with features and integrations, appreciated by some of the largest and most well-known brokers worldwide.

How it all began

Andrey Pavlov and Ilya Holeu founded Spotware in 2010, and launched the cTrader platform less than a year later. Fintech experts with years of technology and FX industry experience, they have given their all to create a product free from all the downfalls they have seen first-hand throughout their careers. Transparency, fairness, impeccable execution and a trader-centric approach have become the key to the product and the market loved it.

From the moment of signing the first broker to surpassing 50% of some of the largest brokers’ monthly volumes and releasing numerous charting and cloud features, it became clear that cTrader has a lot to offer the fintech industry. The first step towards cTrader’s bright future ahead has been taken.

Where cTrader stands today

With 60+ world-renowned brokers, millions of traders and over 40 integrations with leading liquidity providers, CRMs and data-vendors, cTrader Suite is no doubt the product of choice. cTrader’s STP/ECN customer-centric platform works both ways: granting traders the ultimately transparent all-in-one experience, and benefiting all types of brokers by growing their customer base, and hence increasing their market share.

With so much to offer, and as many reputable awards as the platform had received over the years, is cTrader planning to slow down on innovation and enjoy the fruits of its labour? Definitely not! Believing in innovation to succeed, the Spotware team is working hard on a daily basis to not only accommodate, but to surpass the standards of the competitive FX industry and become the best trading platform provider out there.

“We are already far beyond industry standards in terms of the feature-set, usability and philosophical appeal of our product. And we intend to strengthen that further.” Andrey Pavlov – the CEO and Founder of Spotware comments on his company’s 10th birthday.

If you wish to start your own brokerage, or are interested in finding out more about Spotware’s cTrader, please visit: https://startup.spotware.com/