Spotware Systems set to roll out AMF Compliant Account type

The accounts will be made available following the release of the next version of Spotware Systems’ cServer.

Spotware Systems, a widely known developer of technology solutions for the online trading industry, today announces the upcoming support for a new AMF Compliant Account type. This will be made available following the release of their next version of cServer.

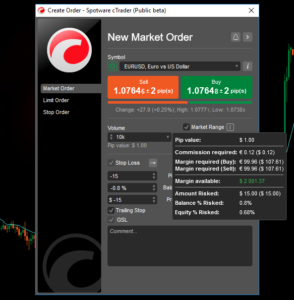

cTrader is the first White Label trading platform to announce support for French clients in conjunction with the recent statement (so far only issued in French language by France’s financial markets regulator AMF). According to the statement, brokers must offer a mandatory Guaranteed Stop Loss to their customers among other attributes which relate either to the technology offered or administrative and marketing efforts of the broker.

cTrader is the first White Label trading platform to announce support for French clients in conjunction with the recent statement (so far only issued in French language by France’s financial markets regulator AMF). According to the statement, brokers must offer a mandatory Guaranteed Stop Loss to their customers among other attributes which relate either to the technology offered or administrative and marketing efforts of the broker.

A unique attribute of cTrader’s implementation is that the Guaranteed Stop Loss will work in conjunction with the option to choose the trigger method of the GSL (trade side, opposite side, second trade side, second opposite side), extending the protection that is made available to traders.

“Speaking on behalf of the entire team at Spotware, we are proud to have reacted to introducing a critical feature even before any English statement was published by the French regulator or any other European regulator. In a matter of days this feature was in R&D. Thanks to our agile development approach we are now waiting to release the feature with the next compatible version of cServer according to our version control schedule.” James Glyde, Chief Commercial Officer, Spotware Systems.

cTrader is already well equipped with an extensive range of tooltips to help deliver the financial risks to traders before committing to any order.

“We are always looking to increase visibility of financial risks, with or without pushes from the ever changing regulatory landscape.” James Glyde, Chief Commercial Officer, Spotware Systems.