Will US retail numbers for January surprise the markets with further improvement? – Guest Editorial

Ramy Abouzaid, Head of Market Research at ATFX (AE) goes into great detail about the movements in the retail industry in North America, looking in particular at January’s sales figures across the country

Ramy Abouzaid, Head of Market Research, ATFX (AE)

The retail sales figures are a significant part of the economic data released by the US economy, and its release is one of the most influencing events in the market during the month. The importance of the retail sales report is that it is a good reflection of the current state of the US economy, especially for its consumption appetite, and as it is considered a significant measure of the inflationary pressure. Even though the data is not as vital as the monthly nonfarm payroll report, it remains on the top of data closely watched by the Federal Reserve while deciding the MonPol.

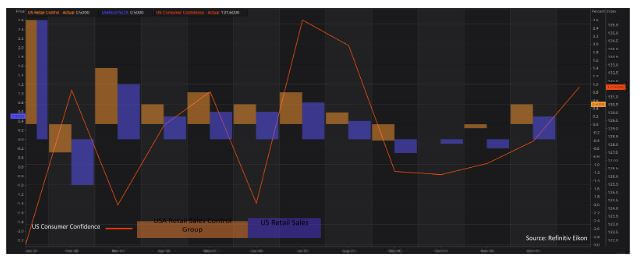

Retail sales rose by 0.3% in December, and it significantly affected the market expectations. Concurrently, the retail sales reading for November was revised to 0.3% from its prior figure of 0.2%.

The improvement was widespread, as in increase in sales was recorded in all categories but one – sales of cars and car parts dealers, which are considered to be volatile commodities by nature, as they decreased by (-1,3%) during the month. Among the remaining volatile groups, sales increased by 2.8% at petrol stations, 1.4% in building materials and garden equipment stores and 0.2% in food and beverage services.

Retail Sales Control Group, which exclude volatile components (gas, cars, building materials, food services and retails packaging) increased by 0.5%, slightly above of the median forecast by 0.4%. However, the previous month’s Retail Sales Control Group were revised to (-0.1%) from (+0.1%) in the previous reading.

Within the Control Group, the monthly changes ranged from 0.1% decrease in miscellaneous furniture and home furniture stores to 1.6% in clothing and accessories stores. Whereas, we noticed sales growth for non-chains retailers, which is usually a rapidly growing category, yet it is a limited increase of 0.2% for the month of December.

Nonetheless, what we can expect for January’s reading, following this poor performance in November – and what December’s data is revealing to us – that American consumers have qualitatively eased caution during the month of December. Despite this easing, a quick look on 2019 quarterly reading (Q4) for retail sales control group failed to the keep rapid pace with the of Q3 and Q2.

However, positive factors are strongly present; primarily, the growth in the labor market and the improvement in the average hourly earnings – which showed a growth of 3.1% in the last report issued on February 7, 2020 – as well as the improvement in US consumer confidence and the growth of employment opportunities and fixed income. All these factors, will drive the trend of consumption toward further improvement. We can expect Retail sales in the first month of 2020 to grow by 0.4%.

In addition to all of the above, we should not lose sight of the fact that the recent signing of the “phase one” of the trade agreement with China provides additional support for the optimistic situation. Well, at least in the short term. The deal, which cuts tariffs on various goods – which did take place after China announced tariffs reduction that was previously imposed on a group of American commodities and goods – should provide additional comfort to the American consumer for the near future.

What is Retail sales report?

The Data collected for the Retail sales report is based on 13 major types of retailers, ranging from good and beverage stores to gas stations.

However, it is extremely significant to pay close attention to the more volatile components of the data collected in this report. For example, the prices of cars, gas, and foodstuffs are strongly influenced by seasonality and the fundamental changes in the prices of raw materials. Also, among other factors – that must be taken into account when reviewing the retail sales report – are political instability, high oil prices, and even extreme weather conditions. As these factors may lead to a lower consumer confidence, which would translate to a decline in consumer spending.

Many data and sub-readings are included in the Retail sales report. Therefore, most traders focus their attention on couple of basic statistics. Their primary focus is directed on the key figure of “Advanced Retail Sales”, along any revisions that might be issued for previous reports. It should be noted that analysts’ expectations tend to incorporate more uncertainty during holiday periods, when consumer spending usually increases. Data release during these periods is often subject to major reviews.

The Retail Sales Control Group report remains an important indicator of investors and traders. It is the control group for all retail sales, except for car dealers and retailers of building materials, gas stations, office supplies stores, mobile homes and tobacco stores. This filtered figure gives a more accurate method to measure consumer spending, which is a large component of US GDP.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.