Rakuten Card to set up US banking business

Rakuten Bank America will deal with credit card issuing and acquiring, personal loans, business loans and deposits.

Rakuten Card Co., Ltd., a wholly owned subsidiary of Rakuten Inc (TYO:4755), announces today that it has resolved to establish a company which will commence a Banking Operation in the United States, pending approvals.

Since the launch of an affiliate service in 2005, Rakuten established an E-Commerce service in 2010 and has expanded its business into various areas such as, membership-based online cash-back site, e-books, and more in the United States. Rakuten has formed a strong ecosystem in the United States centered around E-Commerce, making it one of the most important regions within its overseas business.

To further strengthen its ecosystem within the United States, Rakuten has resolved to establish an industrial bank in the State of Utah to commence a Banking Operation, pending approval from authorities.

Rakuten Card will follow necessary procedures to provide banking services in the United States.

At present, the potential impact on Rakuten Group consolidated financial performance is expected to be limited.

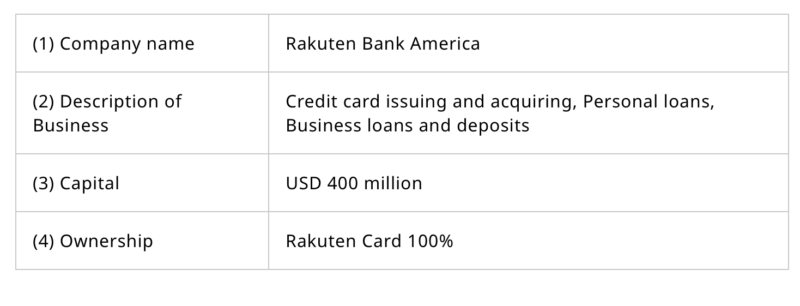

The new entity is set to be formally founded on July 31, 2019. It will be named Rakuten Bank America and its business activities will include credit card issuing and acquiring, personal loans, business loans and deposits. The initial capital will be US$ 400 million.