Rakuten Securities to add “My Chart” functionality to MARKETSPEED II platform

The functionality saves chart settings such as the display color and parameter values of customized technical indicators, so that they can be applied immediately to the displayed chart.

Japanese online trading company Rakuten Securities, a subsidiary of Rakuten Inc (TYO:4755), is set to roll out a new version of its MARKETSPEED II platform on January 19, 2020.

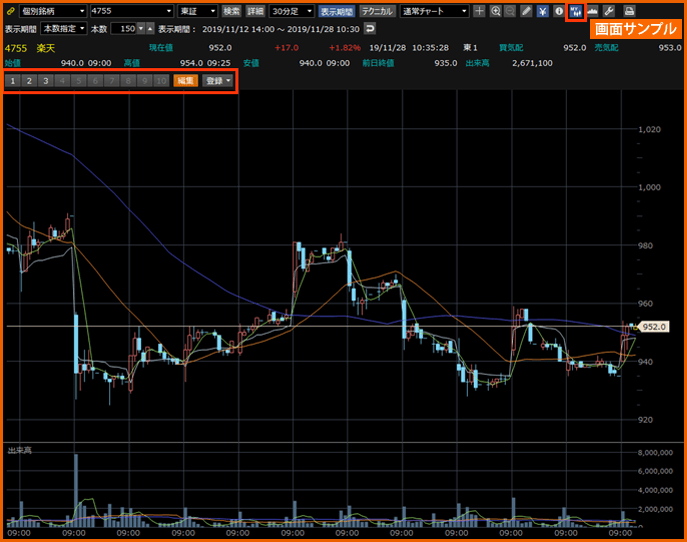

The new version (Ver.1.6.0) of the solution features a raft of enhancements, including “My Chart” functionality which saves chart settings such as the display color and parameter values of customized technical indicators. Then it can be applied immediately to the displayed chart.

This allows traders to avoid the trouble of having to reset the parameter values and display colors of technical indicators each time. With “My Chart”, traders can save up to 10 chart settings and apply them to the currently displayed chart with a single click.

The nw version of the platform will also offer traders to make use of a minute timeframe chart displaying prices from opening to closure of markets on business days.

The platform will also become available as a 64-bit application. The platform will be installed automatically as a 32-bit or 64-bit app depending on the OS of a given device.

Rakuten Securities launched MARKETSPEED II in October 2018. The platform was originally set to be released on September 30, 2018 but then the launch was rescheduled for October 14, 2018, and, after that, the launch was rescheduled again – this time for October 28, 2018. The company explained that the delays reflected the need to improve and strengthen the functionalities of the platform in response to customers’ requests and comments.

The broker has been regularly updating the platform. In one of the updates released earlier in 2019, the platform started offering a multiple order cancellation functionality. Traders can make use of this functionality from the main window. All they have to do is click on the “Order” menu and then select “Cancel all”.