Who is ready for today’s Bitcoin soft fork and who isn’t? As a new coin is born, what will happen to BTC values?

Today, it is likely that Bitcoin will change forever, as two completely incompatible virtual currencies will be created by the soft fork that will put Bitcoin CASH into circulation. With exchanges halting deposits, withdrawals and trading, and prices on the floor, who supports the soft fork and who doesn’t, and what are the ramifications?

Today at 4.00am GMT, CASH, which is being described by cryptocurrency proponents as an ‘altcoin’, was expected to fork off from the main Bitcoin network.

Additionally, today also represents the scheduled activation of BIP 148, which is also known as the User Activated Soft Fork (USAF).

In terms of technical structure, the new coin which will be invoked as a result of the fork from the main Bitcoin network, will be called Bitcoin CASH which will come into being as User Activated Hard Fork (UAHF) which is a miner activated hard fork, and all holders of Bitcoin holders will receive an amount in the newly generated Bitcoin CASH, which is valued at an equivalent read-across value.

The result of this fork is that values may be affected tremendously, as well as how the coins are traded on dedicated electronic exchanges.

Thus, some Bitcoin entities have begun to support the new Bitcoin CASH altcoin, and some have tendered their intention not to support it, most of which are mining pools.

Some examples of this include Slush Pool, which, along with other mining pools such as Bixin, will not support Bitcoin Cash and its August 1 hard fork execution.

Initially created by Bitmain, Bitcoin Cash, formerly known as Bitcoin ABC, is a hard fork that is being developed and launched by a few mining pools led by ViaBTC. It aims to mine 8 MB blocks, which are eight times larger than that of Bitcoin, and will maintain a network without the implementation of the Bitcoin Core development team’s transaction malleability fix and scaling solution Segregated Witness (SegWit).

Some electronic trading companies have been preparing themsevles for the fork, one of which, as reported by FinanceFeeds, is GMO-Z.com which is a member of the Japan Cryptocurrency Business Association.

GMO-Z.com stated its intention to halt bitcoin deposits and withdrawals in the advent of the outcome of the User Activated Soft Fork.

As far as how exchanges will manage the fork is concerned, there is a specific procedure.

For those who are storing Bitcoin in a secured e-wallet, the existing BTC balance will be credited and matched on the Bitcoin CASH chain. Splitting the coins then becomes the responsibility of their holder, should the holder wish to trade one side or the other.

According to many sources, splitting the coins is a fairly complex and technical process. After the fork occurs, users should monitor the Bitcoin Cash price so judge the potential gain against the possible risk, plus the time and effort required.

BIP 148, which is an acronym for Bitcoin Improvement Proposal number 148, represents the terminology used to define the User Activated Soft Fork that requires miners to signal for Segregated Witness (SegWit), which in turn is signaled by miners setting the version number of blocks mined.

As of today, nodes that enforce BIP 148 will reject any block from miners that do not signal SegWit readiness along with any block that is built on top of a block that does not signal support.

As with the actual fork relating to the generation of Bitcoin CASH, there are proponents and opponents, optimists and those who are ambivalent.

Among those optimistic toward the implementation of BIP 148 are Bitcoin Core developer Luke Dashjr, Lead Maintainer of Bitcoin Core Wladimir J ven der Laan, and Bitcoin Core development veteran Eric Lambrozo.

Bitcoin community mavericks Trace Mayer and Jeff Berwick are abivalent toward its effect, but believe that it is an important development that could affect transactions of all cryptocurrency therefore believe that it should be something to bear in mind.

Exchanges, such as Coinfloor, have detailed their policy with regard to whether trading will be halted or suspended during today’s soft fork and hard fork, notifying users that from August 1, there is a definite possibility that two incompatible versions of Bitcoin will emerge.

The venue states:

- Bitcoin (aka. Bitcoin SegWit2x, SegWit, UASF, Core, etc.) will remain in consensus with the currently active Bitcoin network consensus rules.

- Bitcoin Cash (aka. Bitcoin ABC, Bitcoin Cash, UAHF, etc) will not be in consensus with the currently active Bitcoin network consensus rules.

A number of our clients have asked whether we will support Bitcoin Cash if it gains significant traction and what will happen to deposits, withdrawals and trading of bitcoins after August 1st.

To clarify, we will be doing the following:

- We will continue to allow deposits, withdrawals, and trading of Bitcoin. From 4pm BST on July 31st, we will temporarily move to making bitcoin withdrawals from cold storage only. This means that withdrawals will happen 1 – 2 times each working day.

- If in the period after August 1st, Bitcoin Cash gains significant traction, we will enable deposits, withdrawals, and trading of Bitcoin Cash coins. Conversely, if in our view Bitcoin Cash does not gain significant traction, we will not support it.

Additionally, the company has today made clear notifications on its home page that all trading, withdrawals and deposits are suspended as well as the likelihood of downtime due to upgrades required to manage the aftermath of the soft fork.

This is just one example, as many venues have followed suit.

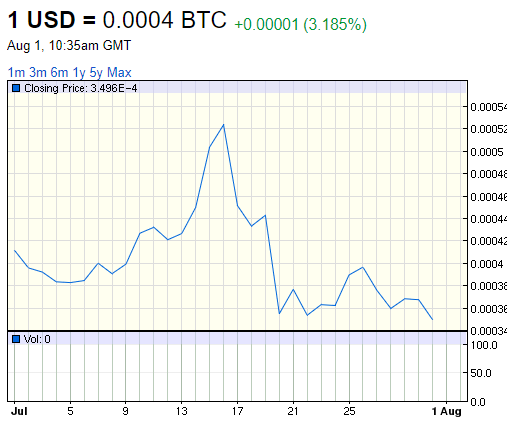

Indeed, the value of Bitcoin has collapsed today, as demonstrated by the chart below, once again highlighting the very reason why it is extremely unlikely that any cryptocurrency will ever be accepted as a genuine financial instrument, and will never be part of the priorities of major venues or banks – the only valuable component being the blockchain technology that underpins it and is intrinsic and inseparable.

Interestingly, Japan, one of the most prolific supporters of Bitcoin as a payment medium in many mainstream activities, has a network of over 5,000 stores and restaurants which use Coincheck Payment Services to accept Bitcoin for purchasing items available on the retail market.

The company had originally stated that it would suspend its service on August 1, however last week Coincheck retracted this and stated that it would continue to process payments so that merchants can continue to accept payments with no restrictions.

This lays retailers and customers open to massive price fluctuations as the Bitcoin world and its venues has to navigate through a branching off period and creation of two incompatible currencies, thus meaning that the conversion to fiat currency at retailer or customer end would be so variable that it is not for the feint hearted.

Blockchain technology has been subject to enormous and unprecedented investments by banks, venture capital houses and large multinational professional services consultancies like PriceWaterhouseCoopers, largely due to its ability to automate distributed ledger functionality.

Once a way of developing blockchain-style database technology independent of Bitcoin, it will be very hard to see any future for digital currency outside of nations with capital control laws.