Refinitiv reports $428 billion in total FX volume for November

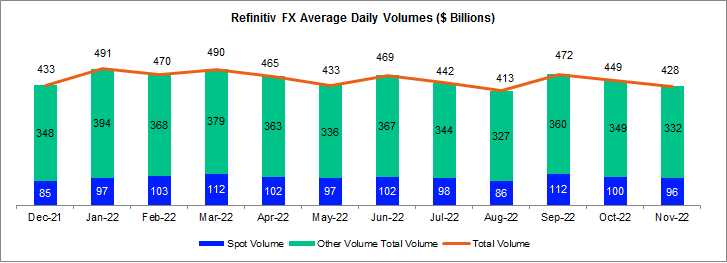

Refinitiv, the former Financial and Risk business of Thomson Reuters, today reported that the average daily volumes (ADV) of currency trading were $428 billion last month on the company’s main FX trading services.

November’s ADV figure is the lowest in two four months, namely since currency volumes bottomed out at the $413 billion mark in November 2021.

Foreign exchange trading volumes across Refinitiv Matching and FXall platforms were down 4.7 percent from $449 billion in October 2022. The figure was virtually unchanged from $430 billion in November 2021, and also reflects a 13 percent drop from March’s yearly high.

Spot FX volumes at Refinitiv, still partly owned by Thomson Reuters, held up much better than other volumes, which include swaps and options. The institutional venue reported $96 billion was FX spot, representing a 4 percent drop over the monthly interval when compared to $100 billion in October 2022. Over a yearly basis, the spot turnover outpaced its counterpart of November 2021, which came at $88 billion.

Weaker activity in other transaction types, including forwards, swaps, options and non-deliverable forwards (NDFs), contributed to the monthly drop, having clocked in their worst month in three months. The figure averaged at $332 billion daily, which is down 5 percent from $349 billion in the previous month.

Refinitiv’s figures reflect the trend observed in the monthly figures from many of the major trading platforms which have seen record-breaking volumes in the first half before turning to suffer lackluster activity.

Refinitiv has recently struck up a strategic agreement with FXCubic, a trading technology provider for institutional and retail brokers, to integrate its Elektron as a service into their ecosystem.

Depending on their business model and market conditions, Refinitiv Elektron offers partners an ultra-low latency order routing and pricing engine, also giving the institutions the opportunity to connect to a wide range of liquidity providers. This includes cross-asset market and pricing data, providing 9 million prices updates per second over 84 million instruments and 2.5 terabytes of real-time pricing daily.