Refinitiv reports $459 billion in FX volume for February 2023

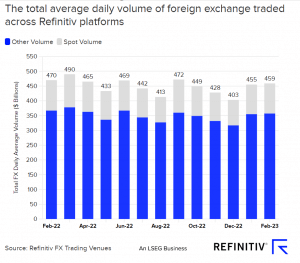

Refinitiv, the former Financial and Risk business of Thomson Reuters, reported that the average daily volumes (ADV) of currency trading were $459 billion in February on the company’s main FX trading services.

Foreign exchange trading volumes across Refinitiv Matching and FXall platforms were virtually unchanged from $455 billion in January 2023. The figure was down -2.3 percent from $470 billion in February 2022.

February’s ADV figure was the highest in six months, namely since currency volumes peaked at $472 billion in September 2022.

Spot FX volumes at Refinitiv, still partly owned by Thomson Reuters, held up much better than other volumes, which include swaps and options. The institutional venue reported $102 billion was FX spot, representing a 2 percent rise over the monthly interval when compared to $100 billion in January. On a yearly basis, the spot turnover failed to outpace its counterpart of February 2022, which came at $103 billion.

A stronger activity in other transaction types, including forwards, swaps, options and non-deliverable forwards (NDFs), contributed to the monthly rise, having clocked in their best month since September. The figure averaged $357 billion daily, which is up from $355 billion in the previous month.

Refinitiv has recently struck up a strategic agreement with FXCubic, a trading technology provider for institutional and retail brokers, to integrate its Elektron as a service into their ecosystem.

Depending on their business model and market conditions, Refinitiv Elektron offers partners an ultra-low latency order routing and pricing engine, also giving the institutions the opportunity to connect to a wide range of liquidity providers. This includes cross-asset market and pricing data, providing 9 million prices updates per second over 84 million instruments and 2.5 terabytes of real-time pricing daily.