Regulatory changes, weak market volatility weigh on CMC Markets’ earnings in H1 2019

Profit after tax was £7.8 million in the six months to end-September 2018, down 69% against the same period a year earlier.

Online trading services provider CMC Markets Plc (LON:CMCX) has earlier today posted its interim results for the six months to September 30, 2018, with regulatory changes and weak market volatility eating into earnings of the Group during the period.

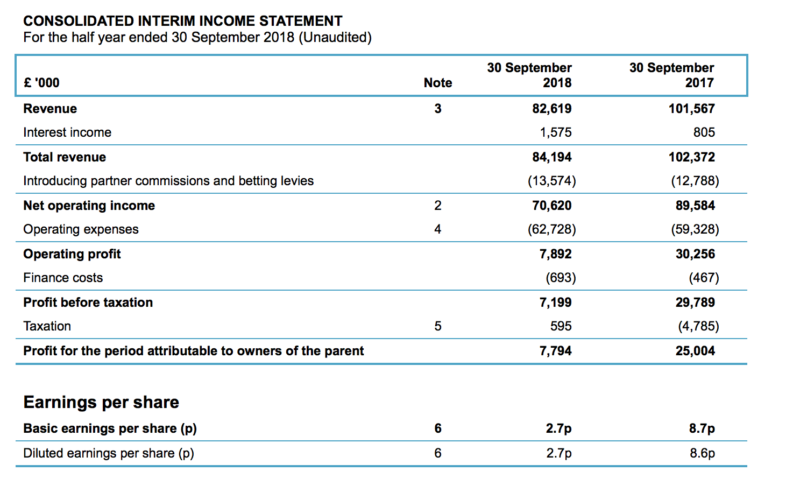

The filing with the London Stock Exchange reveals a statutory profit before tax of £7.2 million for H1 2019, down 76% on prior year (H1 2018: £29.8 million). Profit after tax was £7.8 million, down 69% against the equivalent period a year earlier (H1 2018: £25 million). Basic earnings per share were 2.7 pence in H1 2019 (H1 2018: 8.7 pence).

Operating expenses rose 6% to £62.7 million (H1 2018: £59.3 million), mainly due to investment in the stockbroking business and higher fixed salary costs across the Group. Revenue per active client fell 22% year-on-year to £1,413.

In the UK, active client numbers were down 9% to 11,083 (H1 2018: 12,164) mainly as a result of lower client acquisition which was impacted by a new appropriateness test and higher wealth hurdles for applicants which was implemented in March 2018. Revenue per active client was also lower by 13% at £2,496 (H1 2018: £2,860), mainly driven by an extended period of less volatile, range bound markets.

Active client numbers in Europe (including the German, Austrian, French, Italian, Spanish, Norwegian, Swedish and Polish offices of CMC) were impacted by the implementation of new appropriateness tests that led to an 11% reduction in acquisition numbers which fed through to a 7% decrease in active client numbers. The value of client trades was 5% lower across Europe at £325 billion (H1 2018: £341 billion), with the reduced market volatility in the second quarter limiting opportunities for clients to trade.

On the brighter side, the Australian stockbroking business has benefited from the implementation of the ANZ Bank white label partnership towards the end of H1 2019, with net revenue marking a rise of 33% at £5.5 million (H1 2018: £4.1 million). The majority of the increase is due to the migration of the ANZ Bank intermediaries business in July, with the benefits of the retail migration only affecting one week of the period. There was also growth in existing business brokerage of 6% during the period.

CMC Markets commented that H1 2019 performance can be split into two distinct halves.

“Trading performance in the first quarter relative to the prior year was good, followed by a very challenging second quarter, one of the Group’s most difficult quarters in a number of years”.

The poor performance in the second quarter was blamed on a deterioration in market volatility and range bound markets, combined with the impact of regulatory change.

In terms of outlook, CMC continues to expect 2019 operating costs to be just slightly higher year-on-year, with H2 operating expenses marginally higher than H1.

The brokerage continues to monitor the changes to UK and European retail trading activity and its likely impact on revenue in the medium term, including any impact on the broader competitive landscape.