Retail CFD traders lose over $428m in the week 16–22 March 2020, ASIC analysis shows

Based on a sample of 12 Australian licensed CFD providers, retail client losses were just over $428 million gross (or $234 million net) during the week 16–22 March 2020.

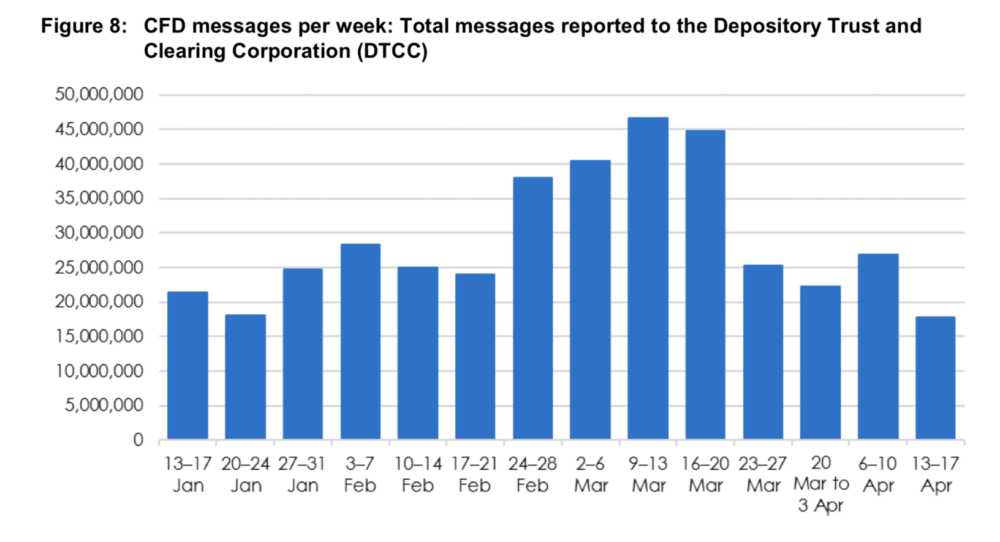

The Australian Securities and Investments Commission (ASIC) today published a paper including its early observations on trading in securities and contracts for difference (CFDs) during the period of high market volatility caused by the COVID-19 pandemic.

In the week 16–22 March 2020, based on a sample of 12 Australian licensed CFD providers, retail client losses were just over $428 million gross (or $234 million net). The 12 providers account for around 84% market share, so the aggregate retail client losses across the industry for this single week may be higher.

Many retail client accounts went into negative balance in the week commencing 16 March. A total of 5,448 retail client accounts of the 12 providers in the sample (or 2% of their retail client accounts that traded during that week) went into negative balance to the value of over -$4 million in aggregate. That is, they lost their initial investment and owed a further $4 million to the CFD providers. Some of the providers absorbed the losses themselves.

Also, ASIC has seen very significant increases in the cost of holding oil CFDs overnight (up to 220% per annum). For a hypothetical $100,000 exposure to oil CFDs ($1,000 initial investment at 100:1 leverage), overnight funding costs of 220% per annum would amount to around $600 per night—around 60% of the initial investment in fees alone in one night.

The average daily securities market turnover by retail brokers increased from $1.6 billion in the benchmark period (22 August 2019 to 21 February 2020) to $3.3 billion in the focus period (from 24 February 2020). Retail trading as a proportion of total trading increased marginally, from 10.62% to 11.88%, when benchmarked against the backdrop of total average daily securities market turnover—which increased from $15 billion to $28 billion (counting both sides of each trade, consistent with retail numbers).

Retail brokers were net buyers of securities over the focus period, buying $53.4 billion and selling $48.4 billion.