Retail investment firms rate FCA’s effectiveness at 6.7 out of 10

The effectiveness score given by retail investment firms to the UK regulator was lower than the average given by all regulated firms.

The UK Financial Conduct Authority (FCA) has earlier today published a report summarizing the findings of a survey of FCA-regulated firms. The survey gives views across the financial services sector of the FCA’s performance as a regulator. The report details the results from the 2019 survey, which took place between January and April 2019.

A total of 10,022 firms were invited to take part, this included all fixed portfolio firms and a sample of flexible portfolio firms. In total, 2,888 firms completed the survey, at a response rate of 29%. An additional 2,500 consumer credit firms were invited, 148 of which took part.

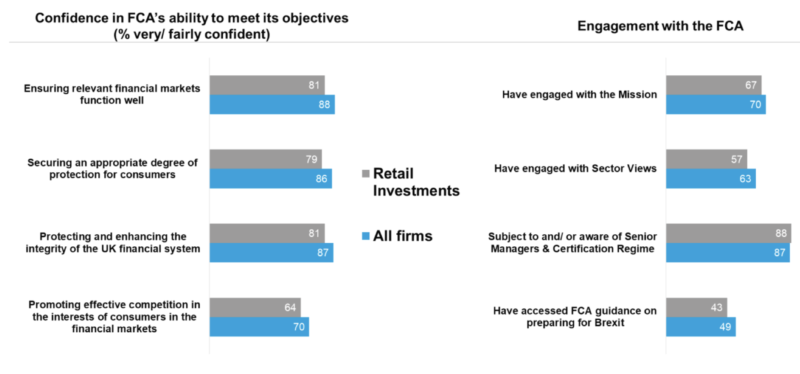

Inter alia, firms were asked to rate their satisfaction with the relationship they have with the FCA, and how effective the FCA has been in regulating the financial services industry in the last year. Retail investment firms gave the FCA a rating of 6.7 when it comes to effectiveness. This is lower than the 7.2 across all sectors. The satisfaction with relationship with the FCA was 7.4 among retail investment firms, also lower than the rating of 7.6 across all firms.

The FCA used a specific supervision categorisation in the survey, classifying respondents either as Fixed portfolio firms or Flexible portfolio firms.

Fixed portfolio firms are a small population of firms (out of the total number regulated by the FCA) that, based on factors such as size, market presence and customer footprint, require the highest level of supervisory attention. These firms are allocated a named individual supervisor and are proactively supervised using a continuous assessment approach.

Flexible portfolio firms are proactively supervised through a combination of market-based thematic work and programmes of communication, engagement and education actively aligned with the key risks identified for the sector in which the firms operate. These firms use the FCA Customer Contact Centre as their first point of contact as they are not allocated a named individual supervisor.

Let’s note that almost all Fixed firms (97%) have accessed FCA guidance about preparation for the UK’s withdrawal from the EU. Half of Flexible firms have done so (50%). Among those who have accessed guidance, 77% of Fixed firms and 73% of Flexible firms found it helpful.

When asked what guidance or support they would most like from the FCA during any transition period following the UK’s withdrawal from the EU, the most common responses from both Fixed and Flexible firms were:

- clear guidance on changes to regulatory requirements;

- regular updates from the FCA,

- and tailored guidance for each sector.

Satisfaction among Fixed firms has fallen since 2018, from 7.3 to 6.9, while the effectiveness score has remained relatively stable (6.8 in 2019, compared with 6.9 in 2018).