Robinhood Wants To Give It Back To The Poor

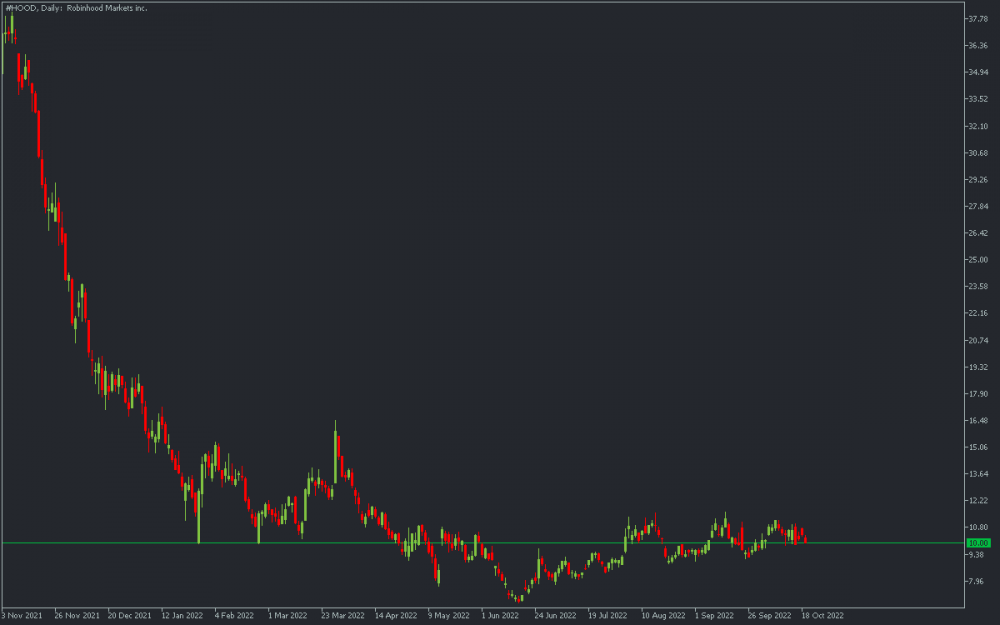

Falling by 92% since the IPO, Robinhood (HOOD) is far from feeling great. The stock market that has been booming because of helicopter money in 2020 and 2021 resembles a dead man now.

Both retail and institutional investors and traders are quiet as a mouse, waiting for the recession to end. Still, there’s hope for the HOOD stock that gained 34% over the last four months. FBS analysts decided to take a closer look at the company ahead of its earnings report at the beginning of November.

Latest Robinhood News

After the Fed stopped the quantitative easing process and decided to fight inflation, users started to flee from the Robinhood app. According to its August 2022 report, monthly active users fell by 29% annually, indicating a loss of interest in the application and the money deficit. Not surprising, considering the enormous activity over the previous two years and current economic concerns.

While Robinhood is an application for retail traders, economic downturn hits it earlier than it does other businesses. As usually happens on the stock market, retail traders suffer the most when the recession starts. It has been true for the last hundred years, and the crisis of 2022 won’t be an exception. Over the year, HOOD’s Assets Under Custody (AUC) decreased to $74.6 billion from $103.5 billion (a 31% decrease).

Even more interesting is that the biggest part of the activity decreases happened due to the cryptocurrency market. Robinhood lost 76% of trading volumes in crypto, not a match to the -10% in the stock market or -6% in option contracts. A bad economic climate resulted in layoffs for nearly a quarter of the company’s staff.

Robinhood earnings forecast

Thus, there won’t be any triggers for retail traders to become more active soon, and Robinhood will likely underperform on the following earnings report. Currently, the EPS estimate is $-0.30, and revenue is expected to reach $352 million, 10% above the last quarter. We suppose HOOD will fail to achieve this revenue level for the reasons stated above. Moreover, the company will likely cut its forecasts for the next quarter.

Technical outlook

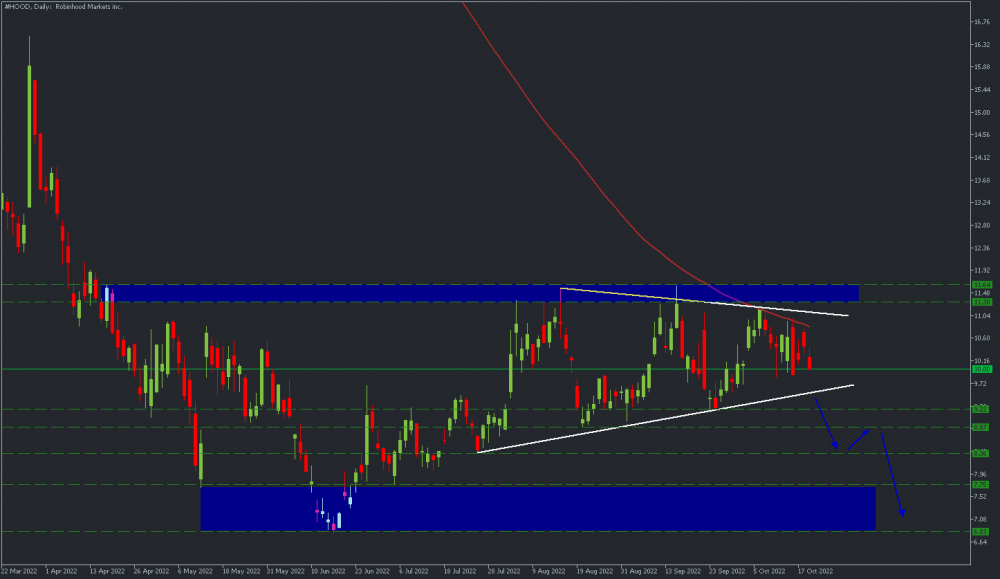

The stock consolidates in a narrowing range, ready for a breakout in either direction. However, considering the macroeconomic outlook and the likely weak earnings report, the consolidation is expected to result in a plunge. The chart printed a series of support levels that may result in a cascade of breakouts. A bearish impulse may drive the price to a historical low (the $6.83-7.75 area). The bad times for the stock aren’t over yet.

HOOD daily chart

Resistance: 11.30; 11.64

Support: 9.22; 8.87; 8.36; 7.75; 6.83