SafeCharge schedules meetings for voting on acquisition by Nuvei

The Court Meeting and the General Meeting, where the deal will be put to vote, are set to be held on July 17, 2019.

Nuvei and SafeCharge International Group Ltd (LON:SCH) today announce the publication of the Scheme Document outlining the scheme of arrangement of the acquisition of SafeCharge by Nuvei.

In order to become effective, the Scheme requires, inter alia: (i) the approval by a majority in number of Scheme Shareholders present and voting (and entitled to vote), either in person or by proxy, at the Court Meeting, representing not less than 75% in value of the Scheme Shares held by such Scheme Shareholders present and voting at the Court Meeting (or any adjournment thereof); and (ii) SafeCharge Shareholders passing the Special Resolution to be proposed at the General Meeting. The Scheme must also be sanctioned by the Court.

The Court Meeting and the General Meeting will each be held at Ground Floor, Dorey Court, Admiral Park, St Peter Port, Guernsey GY1 2HT, on July 17, 2019. The Court Meeting will commence at 1.00 p.m. and the General Meeting at 1.15 p.m. (or as soon thereafter as the Court Meeting has concluded or been adjourned).

Under the terms of the acquisition, SafeCharge shareholders will be entitled to receive $5.55 in cash for each SafeCharge share. The price of $5.55 for each SafeCharge Share, being equivalent to £4.36 per SafeCharge Share based on the Announcement Exchange Rate, represents a premium of approximately 25% to the Closing Price of £3.50 per SafeCharge Share on May 21, 2019 (being the last Business Day before the date of this Announcement).

The SafeCharge Board considers the terms of the acquisition to be fair and reasonable, and in the best interests of SafeCharge shareholders as a whole. The Board recommends unanimously that SafeCharge Shareholders vote to approve the Scheme at the Court Meeting and vote in favour of the Special Resolution to be proposed at the General Meeting, as all of the SafeCharge Directors who are interested in SafeCharge Shares have irrevocably undertaken to do or procure (in respect of SafeCharge Shares in which their spouses, civil partners and related trusts become interested) to be done, in relation to their beneficial holdings of, in aggregate, 3,443,579 SafeCharge Shares representing approximately 2.3% of the SafeCharge Shares in issue on June 17, 2019 (being the Latest Practicable Date).

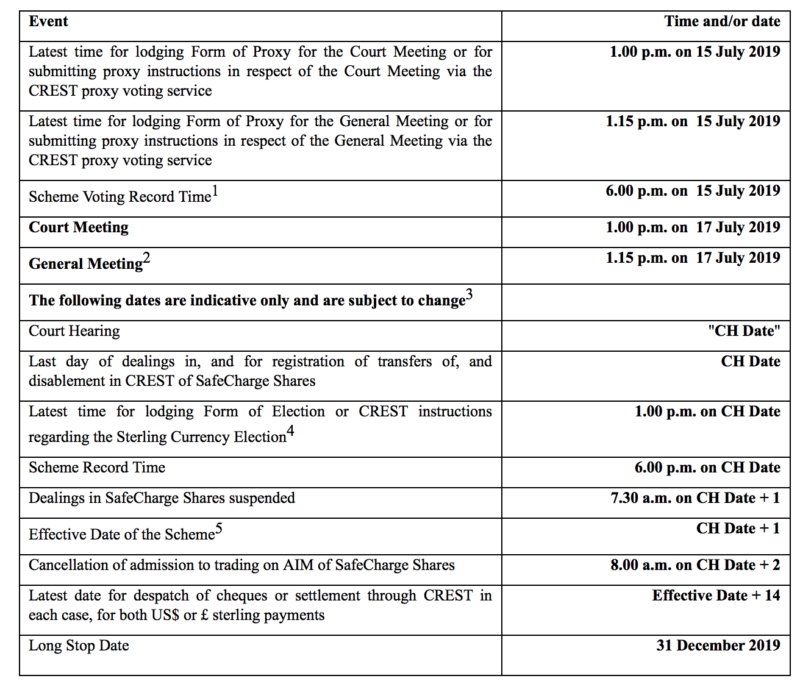

The Scheme Document contains an expected timetable of principal events relating to the Scheme. Subject to obtaining the approval of SafeCharge Shareholders at the Court Meeting and the General Meeting, the sanction of the Court and the satisfaction or, where applicable, the waiver of the other Conditions, the Scheme is expected to become effective in the third quarter of 2019.