Who overlooked the equities rally? Saxo Bank capitalizes on exceptional deals due to market mispricing

Saxo Bank opened 21 aggressive intraday equity trades and capitalized massively, as Peter Garnry said he could “smell blood in the streets”.

Last week, the question was asked by some of the FX industry’s most astute experts as to why the focus on FX pairs was so great when other instruments remained completely unchanged in terms of trading conditions, however some stocks were also affected by the results as the FTSE in Britain had a volatile 24 hours.

An interesting perspective on this came to light during the day of the results of the referendum, that being the adjusting of margins and leverave by many companies on currency pairs involving the Pound, whereas stocks and indices as well as pairs involving non-European currencies remained tradable under existing terms, with no margin changes.

On Friday, Andrew Ralich, CEO of institutional FX software development company oneZero spoke to FinanceFeeds on this matter, saying “In terms of technology preparation, from our perspective, we feel that Brexit was a success across the board.”

“At oneZero we saw some unprecedented load on our systems, but throughout the slide we had no reports of execution or connectivity challenges. What will be interesting to learn about in the days to come is how brokers fared with this unexpected move, specifically those who chose to adjust margins on GBP and EUR crosses only. It’s safe to say that many brokers who announced their margin changes leading up to the event did not anticipate the massive moves we saw across the board, specifically in JPY, Indicies and Gold” concluded Mr. Ralich.

Today, this has proven to be a very clear matter that has been observed by further industry executives and indeed acted upon by firms looking to ensure that they made the most from that bout of volatility.

Saxo Bank’s Head of Equity Strategy Peter Garnry is one such executive, the trading desk over which he presides having made a beeline for capitalizing on the mispricing that occurred in the equities markets following the announcement of the Brexit.

Whilst a number of analysts were concerning themselves with the potential volatility in GBP related currency pairs, company stocks were in the keen sights of Saxo Bank’s equities desk.

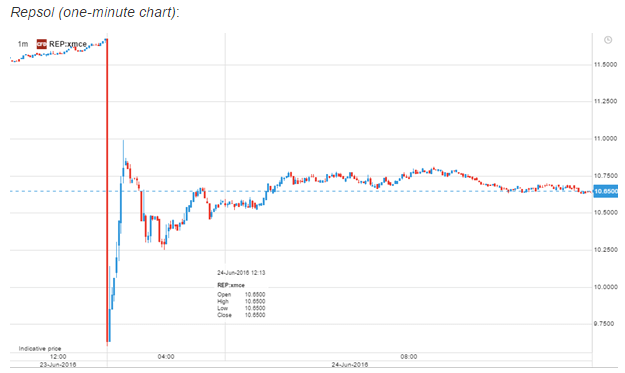

One particular example was stock in Spanish oil and energy firm Repsol.

Repsol, which is perhaps more prominent in the minds of the retail audience for its high profile sponsorship of motorsport teams which spans several decades, is publicly listed on the Bolsa de Madrid, a prominent Spanish stock exchange.

“When the cash market opened our first aggressive trade was in Repsol (REP:xmce) that opened 18% down despite energy stocks in Asia on average were only down 2-4% This was the first gross mispricing in the European equity market” said Mr. Garnry.

“We immediately bought large exposure and the stock rebounded 12% in 13 minutes. That made us smell blood in the streets!!” – Peter Garnry, Head of Equity Strategy, Saxo Bank

The company also placed small directional bets on a scenario in which the UK may remain in the EU, one of them being a long Nikkei 225 and also long on UBI Banca, however the firm adapted its strategy following the result and began rapid intraday trading in 21 instruments for the first 90 minutes of the European cash equity trading. This is when the firm began to profit from its Repsol deals.

“We could not send out trading ideas out to clients at that speed as we had to seize the opportunityto take advantage of the exceptional levels of mispricing. We did circulate our activity ad hoc on emails to clients” said Mr. Garnry.

“Our first position was aggressively adding a large exposure in STOXX 50 in the area 2,675-2,700 immediately taking our portfolio from gross exposure of around 100% and net exposure of 7% to around 200% gross and 107% net” – Peter Garnry, Head of Equity Strategy, Saxo Bank.

“When the UK banks opened down 30-35%, we immediately copied our Repsol trade in Barclays and Royal Bank of Scotland” continued Mr. Garnry.

“All instruments provided a gain to our portfolio except a loss in Lloyds Banking Group. Our biggest P/L gains were STOXX 50, Michael Pagee, Barclays, Peugeot, Bellway, and BMPS and our portfolio is up 14% today” said Mr. Garnry.

“Our trading was so aggressive that we went from around 107% gross exposure to around 400% in less than an hour. When trading and the noise settled in the market, we scaled out at around 0845 GMT closing all intraday speculative positions. However, we kept our core trades so the portfolio when back to being almost neutral” he concluded.

Featured Image: A hive of activity at Saxo Bank’s Trading Floor, Hellerup, Denmark. Copyright FinanceFeeds