Saxo Bank OpenAPI set for identifiers’ upscaling

The company is planning ID upscaling and correction of types for a few IDs which is set to happen on or after September 1, 2020.

Multi-asset trading and fintech expert Saxo Bank is planning to implement changes to its API.

With Saxo Bank’s rapid growth, several identifiers, including PositionIds, OrderIds, and TradeIds are approaching the number of ‘2.147.483.647’. Saxo expects this to happen between October 2020 and December 2020.

If you are storing such IDs in an integer your code may break. In many programming languages 2.147.483.647 is the maximum positive number, which can be stored in an integer. If your code is written to interpret or store such Ids as integers, there is a risk that your code will break when our ids pass that barrier.

Almost everywhere in Saxo’s API, such ids are identified as strings, and if you have also used a string representation in your code, you should not experience any problems. If on the other hand, you have converted these strings to integers in your code, you must now start to consider the impact of the ID’s passing the 2.147.483.647 number.

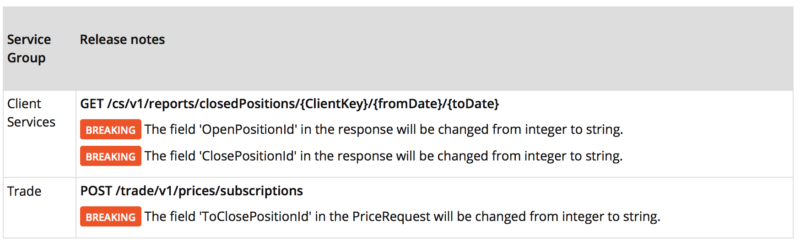

Also, Saxo has to actually update the type of a few infrequently used fields in its API from ‘int’ to ‘string’. When reviewing this issue, Saxo found a few API endpoints, which did not, represent these ids as strings.

Since the fields are used very infrequently, Saxo has decided to make minor breaking changes as outlined in the table below.

Let’s recall that, Saxo Bank has recently implemented changes to its OpenAPI whereby Trade Allocation Keys are no longer allowed to include a broker account.