Saxo Bank rolls out new version of OpenAPI

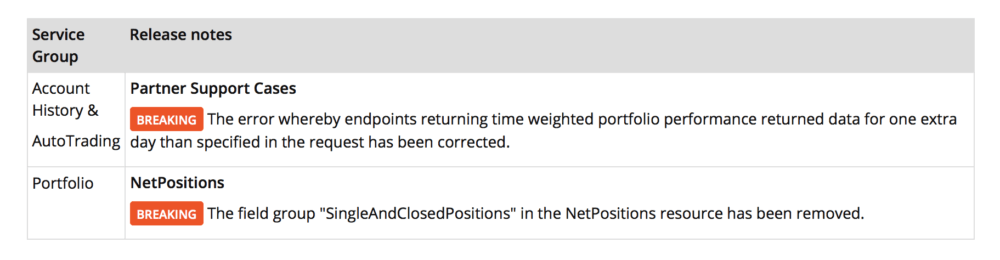

Today’s release removes SingleAndClosedPositions array in NetPositions endpoint.

Multi-asset trading and fintech expert Saxo Bank today released an update to its OpenAPI, with the latest release including some fixes and enhancements. The new API version removes the SingleAndClosedPositions array in the NetPositions endpoint.

The company has earlier warned that it would no longer support SingleAndClosedPositions in the NetPositions resource. This has been marked obsolete/do not use since June.

Your application should not specify the field values “SingleAndClosedPositionsBase” and “SingleAndClosedPositionsView” as FieldGroup values when requesting data. Further, the SingleAndClosedPositions array will no longer be returned in the response. Analysing how a few apps used this array, the developers have found that they were all only fetching this data to get a count of the underlying positions included in the net position. This value is now found in the NetPositionView.PositionCount.

The preceding release included a number of additions and enhancements. For instance, a new resource – ‘CurrencyPairs’, representing all supported currency pairs was added.

Also, a new resource – prices/multileg providing prices for multi-leg orders – has been added. With this addition there is now full support for multi-leg orders in Saxo’s OpenAPI. Multi-leg orders are used when trading option strategies.

OpenAPI supports trading industry standard and custom option strategies, such as Straddles, Condor and Butterfly strategies. These orders are a form of basket orders, where one order is placed to open multiple positions simultaneously. Each order is referred to as a “leg”, and to maintain the desired risk and exposure the exchange guarantees symmetrical filling of all legs.