Saxo Bank shifts to FIFO netting on futures positions

The changes in management of futures positions are effective as of April 6, 2017, on SaxoTrader and as of April 8, 2017, on SaxoTraderGO.

The “first in, first out” (FIFO) rule has been widely known in the world of online trading – this is owed to a great degree to the US financial regulations, and, in particular, to the famous rule 2-43 by the US National Futures Association which states that “Forex Dealer Members may not carry offsetting positions in a customer account but must offset them on a first-in, first-out basis”.

Multi-asset electronic trading company Saxo Bank is now applying this rule to futures positions on its platforms SaxoTrader and SaxoTraderGO. Saxo Bank has announced that it is moving to FIFO netting on futures positions. The change is effective April 6th for the SaxoTrader platform and April 8th for the SaxoTraderGO platform. The shift means that futures trades must be closed in the order they were open.

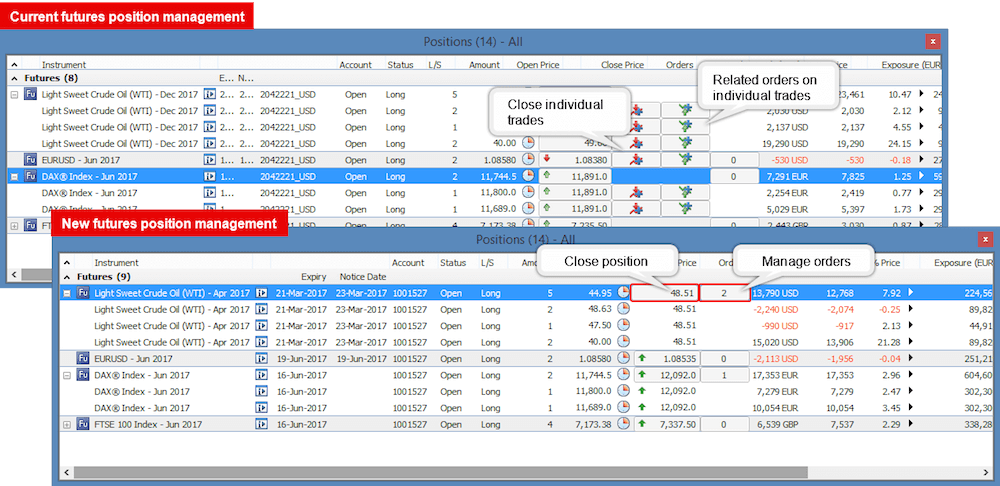

Also, platform features which allow traders to close trades in a different order will be removed, meaning that individual trades in a position cannot be closed directly and that traders cannot place related stop and limit orders to close specific trades.

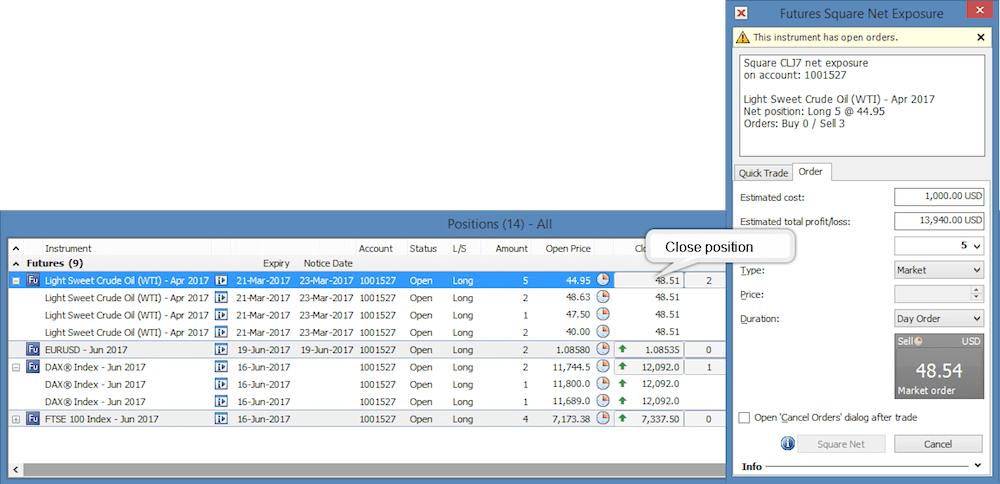

In order to close or reduce a position, traders can place a trade using either the Close button on the position, or by placing a trade using the Trade Ticket.

Concerning related orders, the company notes that Stop loss and Take profit orders cannot be related directly to individual trades. Independent stop and limit orders can be placed instead and managed separately to the position — if traders manually close a position, they will also have to manually cancel any orders.

Perhaps this is the point where we should recall that, in September last year, Saxo Bank announced the launch of a new order driven execution model for FX Spot, FX Forwards and CFDs on Indices and Commodities for the purpose of aligning its practices with those in other asset classes. On top of offering executable prices, the new order model was said to include further enhancements to clients’ ability to have better control and transparency over their orders. These include user defined price tolerances, and price improvements will be passed on to clients, while permitting partial fills.