Saxo Bank’s new Australian CEO elaborates on four initial priorities; Emphasis on institutional expansion

This morning, Saxo Capital Markets, the wholly owned subsidiary of technology-led electronic trading company Saxo Bank appointed Ben Smoker as CEO of its Australian division. Saxo Capital Markets made its inaugural entry into Australia in 2012, and the appointment of Mr. Smoker to lead the operations today gives Saxo Capital Markets an industry executive with […]

This morning, Saxo Capital Markets, the wholly owned subsidiary of technology-led electronic trading company Saxo Bank appointed Ben Smoker as CEO of its Australian division.

Saxo Capital Markets made its inaugural entry into Australia in 2012, and the appointment of Mr. Smoker to lead the operations today gives Saxo Capital Markets an industry executive with over 30 years institutional bank and non-bank experience.

FinanceFeeds spoke to Mr. Smoker today in order to establish four key areas which he intends to further within the initial part of his leadership.

The strategic step for the business is to increase the emphasis in the institutional business in Australia. How will this be done?

Saxo is committed to providing institutional clients and their end customers with multi-asset execution, prime brokerage and market-leading trading technology. From a global perspective, the Saxo institutional offering is core to the Group’s strategic direction going forward and it makes sense for us to make it our focus here locally in Australia leveraging our global strengths.

Which institutional segment is Saxo trying to address now?

Which institutional segment is Saxo trying to address now?

Fintech disruption is impacting the Financial Services industry at a rapid pace. Saxo is well placed to provide services to a variety of institutional segments. We aim to be servicing both the ‘disruptors’ and the ‘disrupted’ including retail banks, brokers, advisers and asset managers and the evolving robo-advisory space.

Our main goal in the institutional space is to facilitate and augment existing and new institutional client business models by leveraging the innovative pallet of global markets trading technology Saxo has at its disposal.

What type of institutional clients is more likely to engage with the Open API solutions?

The Saxo Open API is designed to capture a wide universe of institutional clients as it has the flexibility to support custom integration requirements across a multitude of asset classes. In particular we’ve seen an increasing demand for high quality liquidity provision and multi-asset execution – two areas where Saxo is undeniably a market leader.

Are there any other specific services Saxo will be emphasizing?

Aside from the Open API offering, the Saxo FX Direct Market Access and Prime Brokerage capabilities are two institutional services that we are keen to promote here locally in Australia. Additionally, the Saxo International Equities execution capability is a pre-eminent offering globally and we see the potential for strong local demand for this in the Australian marketplace.

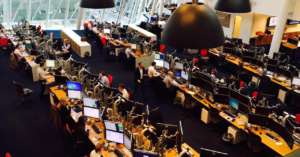

Photograph: Saxo Bank, Hellerup, Denmark. Copyright FinanceFeeds