SBI FXTRADE adds Forex options to offering

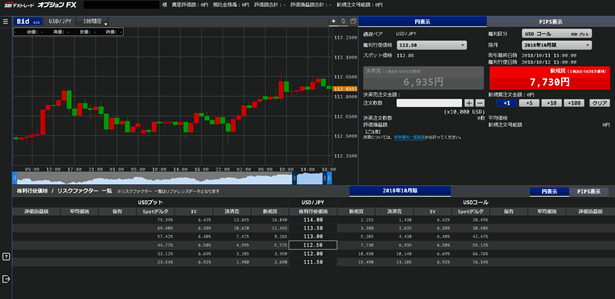

The company will initially offer trading in vanilla options, as this is the standard product when it comes FX options trading.

SBI FXTRADE Co., Ltd., a Forex trading subsidiary of Japanese financial services provider SBI Holdings Inc (TYO:8473), has earlier today announced the launch of Forex options trading. The new service will initially offer vanilla options trading, as this is the standard product when it comes to FX options trading. The company promises to expand the lineup of instruments in the future.

Regarding the rationale for the new addition, the broker says that FX options, although initially aimed at more affluent and institutional clients, can be very attractive for retail clientele too. Plus, such instruments, according to the broker, provide extra opportunities on top of mere trading. FX options, for instance, can be used for hedging too.

The risks for traders are limited as the maximum loss is limited to the option purchase fee. The maximum holding period is 40 days. The broker says that FX options are very different from binary options in terms of risks and trader protection.

The company notes that one of the advantages of trading FX options with it is that the trading system resembles familiar systems such as the one used for trading Nikkei 225 options.

The move marks further expansion of SBI’s foreign exchange services. In September this year, BYFX Global Co., Limited, also a part of SBI Group, announced the launch of its retail and institutional business – offering clients around the globe top-tier liquidity and online OTC trading for Spot FX and Spot Bullion. The broker aims to bring clients a user-friendly and enhanced online trading experience: access to transparent and competitive pricing through aggregated liquidity from the SBI Group, international banks and tier-1 liquidity providers on its unique proprietary trading system DEP FOREX.

As of the end of 2017, SBI Group has attracted more than 1 million customer accounts in the OTC FX industry. The SBI Group aims to build a financial ecosystem with securities, banking and insurance as well as blockchain, AI and crypto-related businesses, pursuing synergy and mutual evolution.