Schwab allows Google Assistant users to access account and portfolio updates through voice-enabled tech

Google Assistant users will be able to easily and securely access certain Schwab account and portfolio updates across multiple devices through voice-enabled technology.

Schwab has announced an integration with Google, enabling Google Assistant users to easily and securely access certain Schwab account and portfolio updates across multiple devices through voice-enabled technology.

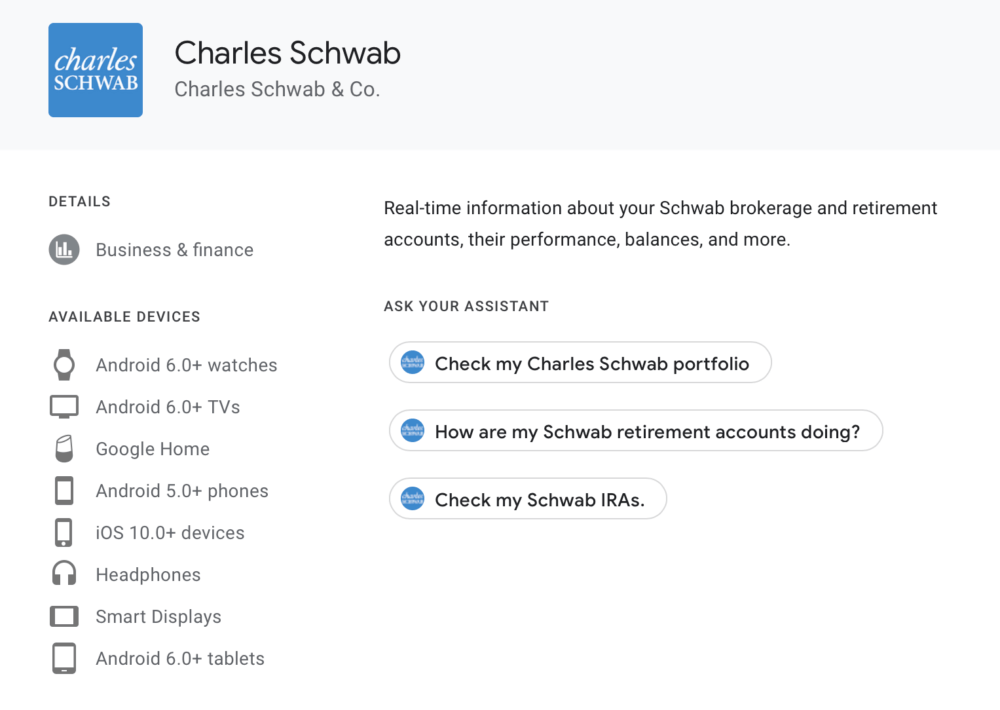

To enable Schwab’s Action on Google, Schwab clients are guided through a quick, simple configuration process. In just a few minutes, clients can follow on-screen prompts through the “Finance” section of Google Account settings where they will input Schwab credentials, consent, and choose accounts to link. The integration does not currently enable brokerage transactions.

Schwab’s Action on Google allows Schwab clients to:

- Track portfolio performance – With a simple request such as, “Hey Google, check my Charles Schwab portfolio,” clients can get real-time updates on how their portfolio is performing;

- Review account information – Ask Google for updates around any linked Schwab account or account type with a prompt such as, “Hey Google, how are my Schwab retirement accounts doing?”;

- Get updates on positions – Clients can ask Google for updates, such as trade price or volume, on specific stocks in their portfolio;

- Access through multiple devices – Schwab’s Action is available to Schwab clients through multiple Google Assistant devices such as the Google Assistant app for iOS users, Google Nest, and other smart speakers and Smart Displays.

Zack Gipson, senior vice president, Schwab Digital Services, comments:

“We’re committed to increasing access to investing for every client with a focus on making both investing and planning easier, more modern, and more approachable. Consumers today expect the brands they do business with to be available whenever and wherever needed, and how they invest should be no different.”