Shareholders of CLSA Premium, f/k/a KVB Kunlun, vote against winding up the broker

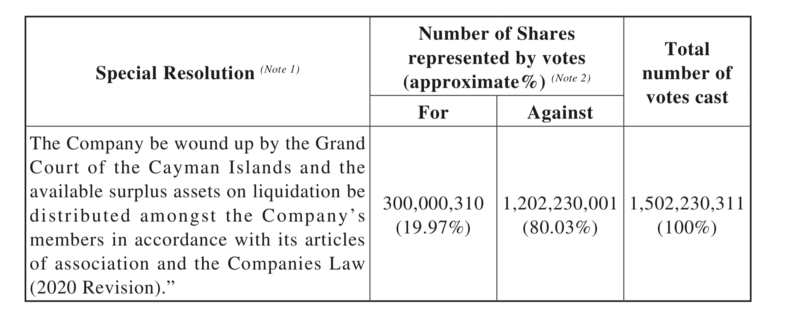

About 80% of the shareholders’ votes were cast against the proposal to wind up the FX brokerage.

Hong Kong-focused retail Forex broker CLSA Premium Ltd (HKG:6877), formerly known as KVB Kunlun, has just posted the results of a vote on the proposal for the company to be wound up.

The Board announces that at the EGM held earlier today (Hong Kong time), the proposed resolution for winding up the company was not passed as special resolution of the company by the Shareholders by way of poll. About 80% of the votes were cast against the proposal.

As at the date of the EGM, the total number of issued Shares was 2,033,290,000 Shares, which was the total number of Shares entitling the Shareholders to attend and vote for or against the Resolution at the EGM. There were no Shares which entitled the holders thereof to attend and vote only against the Resolution as set out in Rule 13.40 of the Listing Rules and no Shareholder is required under the Listing Rules to abstain from voting on the Resolution at the EGM. It is noted that no parties had indicated in the Circular their intention to vote against or abstain from voting on the Resolution at the EGM.

The Company’s Branch Share Registrar in Hong Kong, Union Registrars Limited, was appointed as the scrutineer at the EGM for the purpose of vote-taking.

On June 18, 2020, when the company announced that such an EGM would be held, the management said it expects that the financial performance of the company would gradually improve following the implementation of such business plan, and in turn it will create greater value and return to the shareholders in the long term.