Spotware Systems rolls out new version of cTrader Desktop platform

cTrader Desktop 3.7 includes new economic calendar and the ability for multi-symbol backtesting.

Fintech expert Spotware Systems has rolled out a new version of its cTrader Desktop platform. The latest version (3.7) of the platform is equipped with a raft of enhancements, including a fully-integrated FXStreet Economic Calendar, previously made available in cTrader Web, as well as Multi-Symbol Backtesting for cTrader Automate.

The updated platform enables traders to observe the full list of economic events for a complete Fundamental analysis without leaving the trading platform. The Active Symbols Panel has been equipped with a list of economic events for each selected symbol.

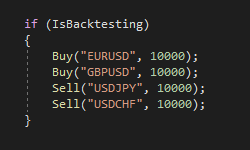

Further, cBots have been vastly improved to use other symbols during backtesting. This comprises the ability to perform trade operations, get historical data, subscribe to tick events and analyze indicators.

Further, cBots have been vastly improved to use other symbols during backtesting. This comprises the ability to perform trade operations, get historical data, subscribe to tick events and analyze indicators.

A new smooth zooming function has been added to charts. Furthermore, one can now zoom in and out via a simple shortcut: Ctrl + Mouse scroll.

Also, the new Pencil tool allows freehand drawing on charts for increased customization and convenience.

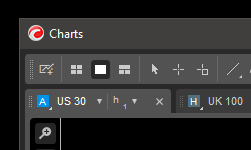

In the new version of the platform, detached windows can contain multiple charts with own charts layout for the bigger picture view. Detached chart containers further comprise their own drawing instruments’ toolbar, and charts can be easily moved between containers and the main window via a simple drag & drop function.

In the new version of the platform, detached windows can contain multiple charts with own charts layout for the bigger picture view. Detached chart containers further comprise their own drawing instruments’ toolbar, and charts can be easily moved between containers and the main window via a simple drag & drop function.

For increased user privacy purposes, all sensitive information, including account number, account balance and cTID name can now be hidden from the screen. These settings can be found in the General Settings section.

Historical data API has been equipped with a variety of new features and API usability improvements. MarketData possesses new methods of: GetBars, GetBarsAsync, GetTicks, and GetTicksAsync. These API methods work for current and other symbols in both – real-time and backtesting.

Also, new API methods have been added to load more history.

Developers now can use clouds between indicator lines. A cloud can be added using a single attribute with 2 line names, such as: [Cloud(“UpperBand”, “LowerBand”)]

cBots and indicators can now change individual bar colors using new API methods: SetBarColor, SetBarFillColor, SetBarOutlineColor, and SetTickVolumeColor.

The latest version of cTrader Desktop also offers other UI improvements. Thus, for instance, for quick access to cBot and indicator parameters in the Automate section, traders can now use the new Parameters Panel. The panel is visible by default, but can be hidden using the Layout menu.

Also, a new chart setting allows to show or hide QuickTrade buttons.

The new Positions Count Badge function displays the number of opened positions per each symbol for increased trader standing visibility.

Finally, an Add New Chart Button option has been added to the main toolbar for swift access. New charts can now be added in a click in both – Multi-Chart and Free-Chart mode.

Spotware Systems has been regularly updating its platforms. The latest version of cTrader Web, for instance, added Pencil Tool & Line Study extension.