Alon Gonen purchases 500,000 shares in Plus500

Plus500’s co-founder Alon Gonen (through Sparta 24 Ltd) purchased 500,000 shares in the brokerage on December 4, 2019.

Plus500 Ltd (LON:PLUS) has just reported that one of its co-founders – Alon Gonen, has purchased more shares in the online trading company.

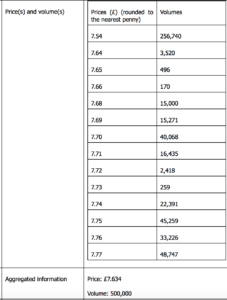

The regulatory filing says that the transactions were executed on December 4, 2019. The shares were acquired via Sparta 24 Ltd. The aggregate volume of the transaction is 500,000 shares and the average price is £7.634 per share.

Let’s recall that, on August 19, 2019, Plus500 Ltd (LON:PLUS) reported that it was notified that certain PDMRs have acquired shares of NIS 0.01 each in the company. The company said back then Alon Gonen acquired 468,469 shares (through Sparta 24 Ltd.) at £7.07 per share.

In the meantime, the brokerage continues to buy back its shares. At the end of October, Plus500 provided an update on the progress of its share buyback program. The company repurchased 1,639,246 shares in the quarter for a total consideration of $14.7 million as part of its $50 million share buyback program that started on August 20, 2019.